How To Use Insurance To Provide Your Family With Financial Protection

How To Use Insurance To Provide Your Family With Financial Protection

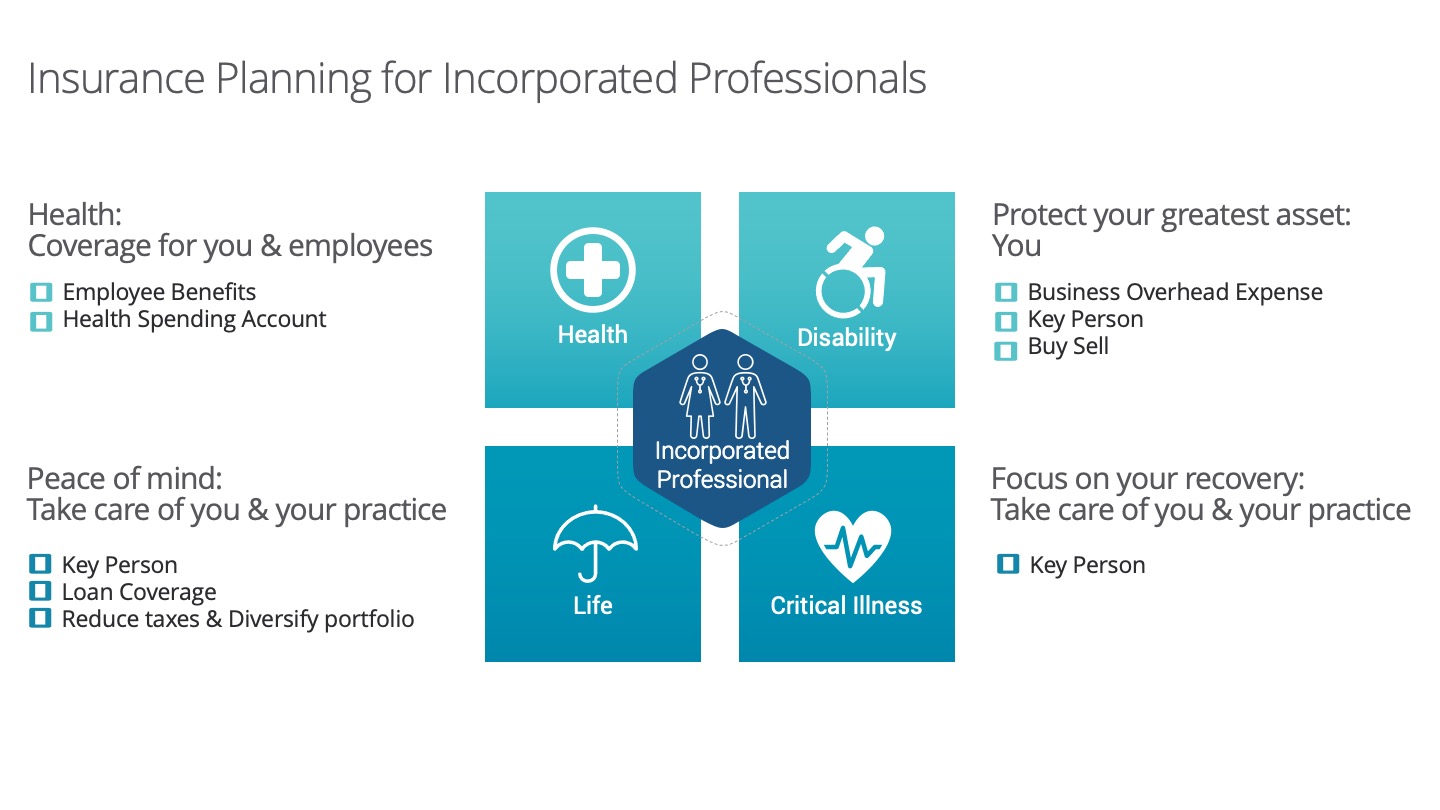

The best way to provide your family with financial protection is with solid insurance planning. These three types of insurance will ensure your family has the financial resources they need if you die, are injured, or become ill:

- Life insurance.

- Critical illness insurance.

- Disability insurance.

Life Insurance

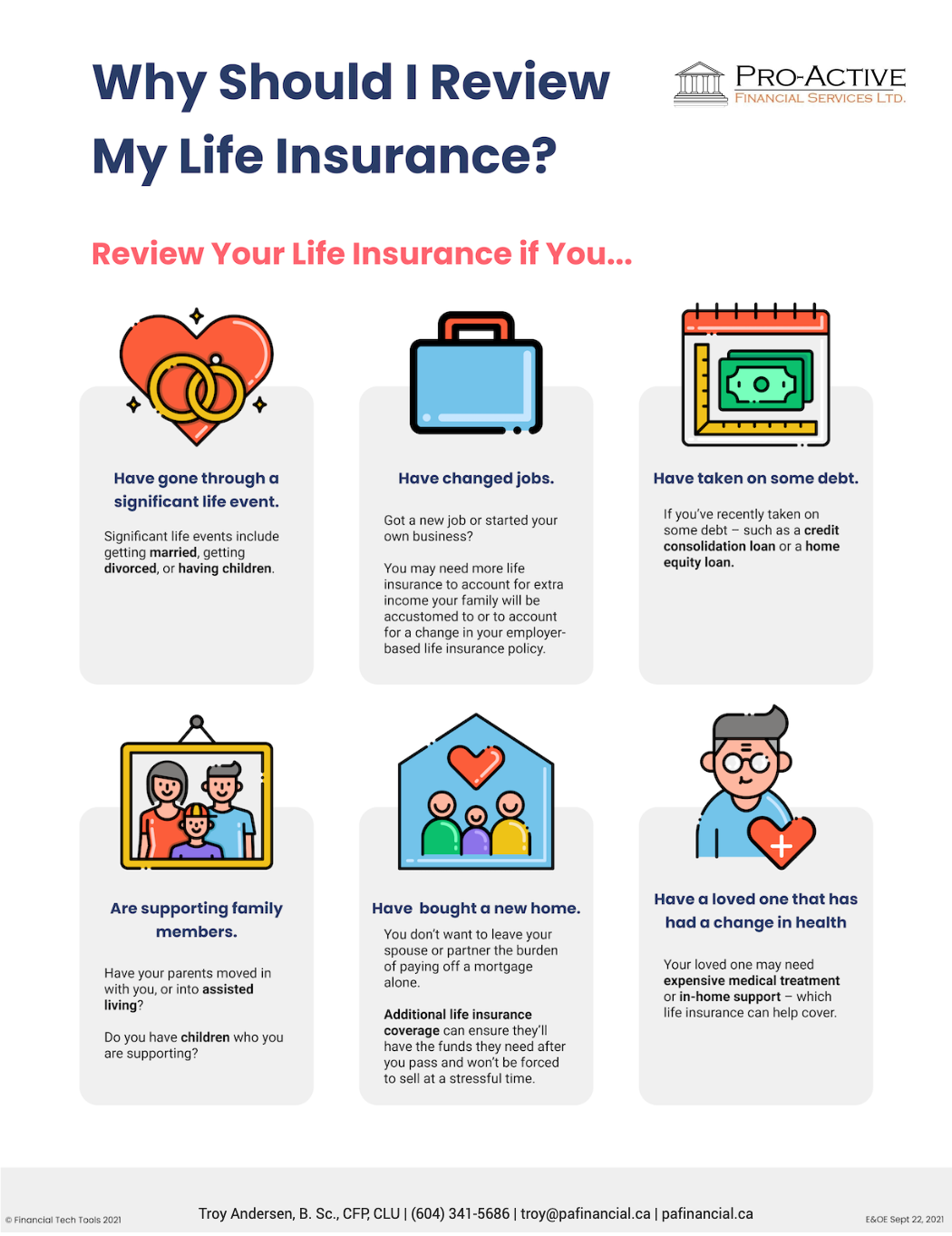

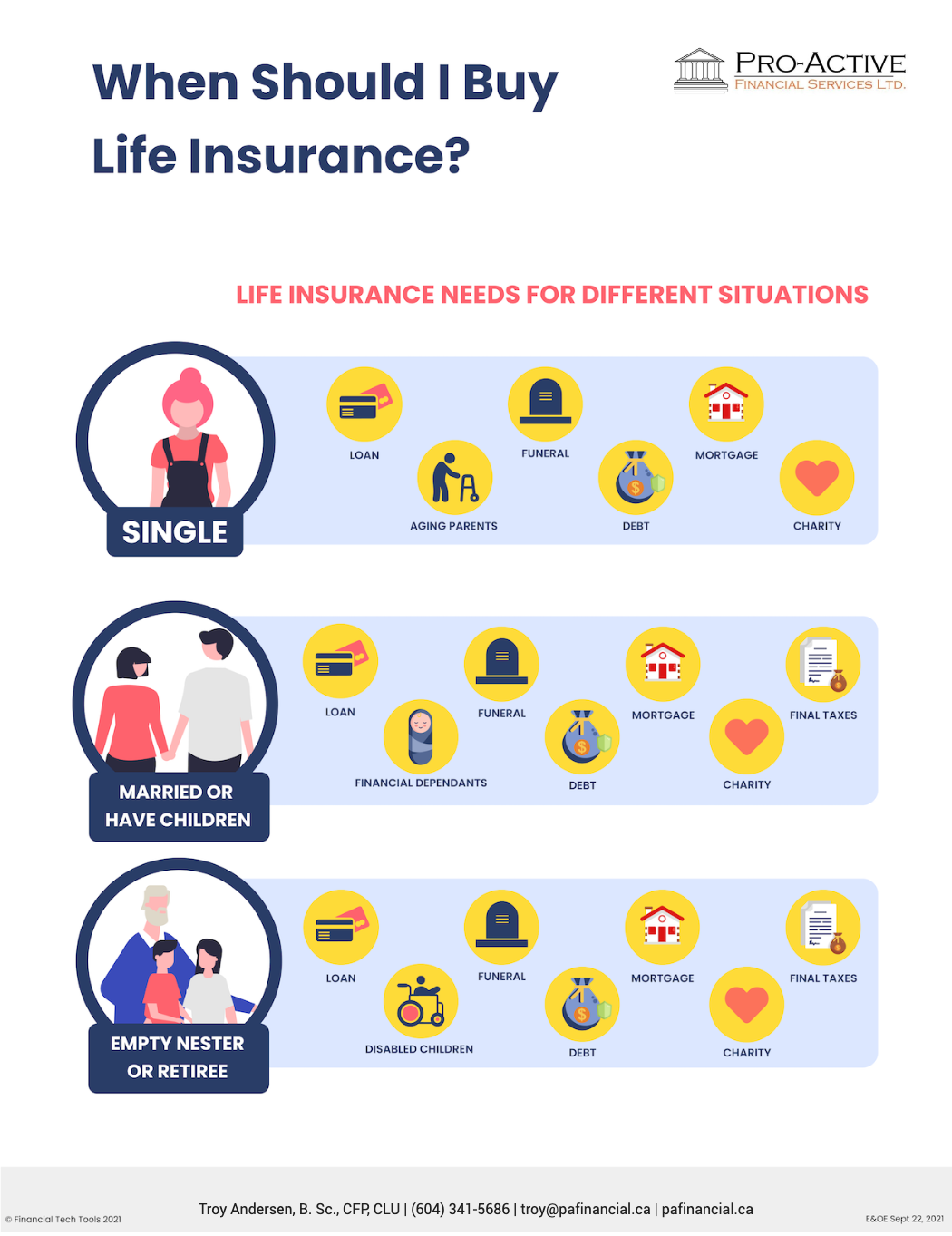

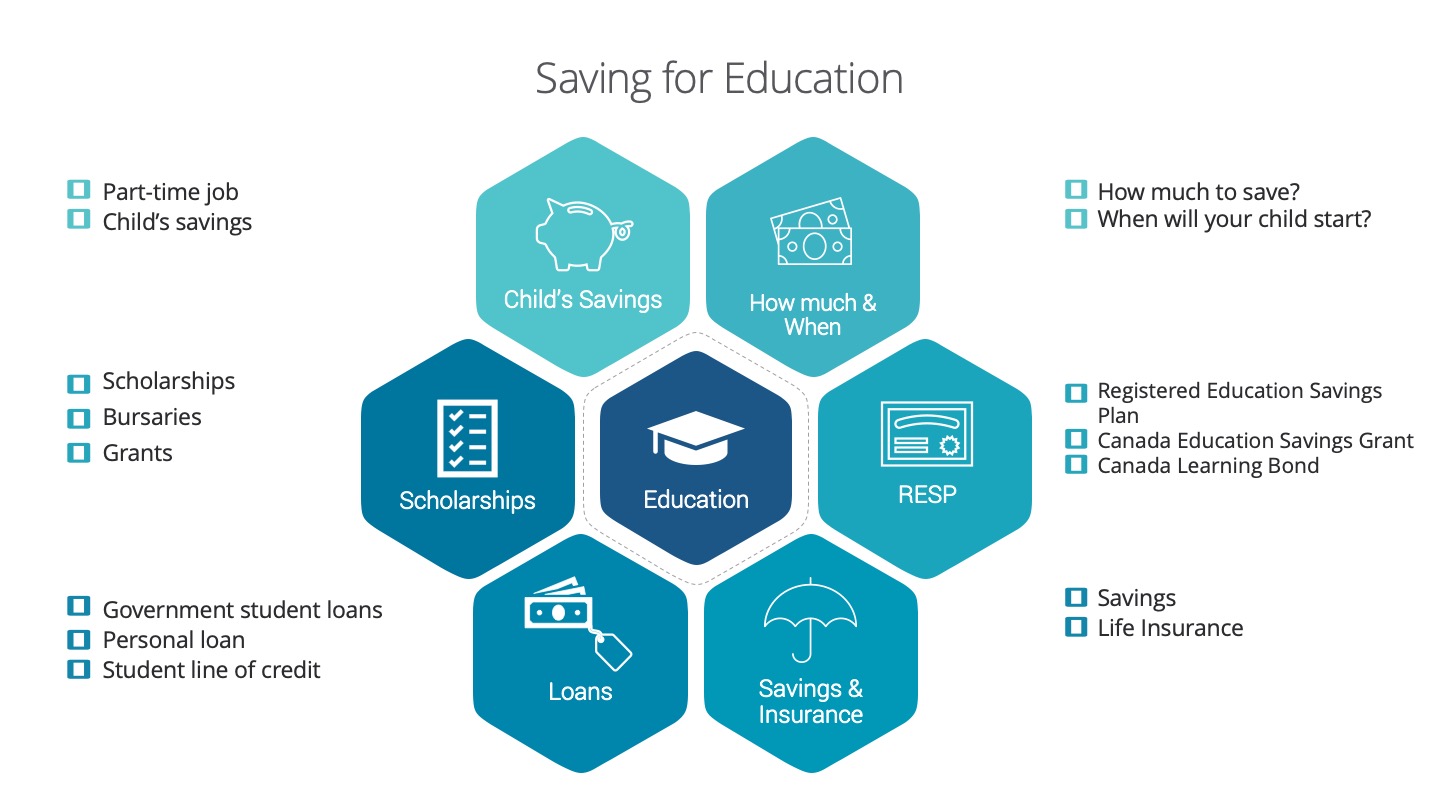

Life insurance is an inexpensive way to ensure your family will have access to a tax-free lump sum payment after your death. Whether you want to give your grandchildren a helping hand getting started in life or provide financial resources for a stay-at-home parent, life insurance can be a great way to do it!

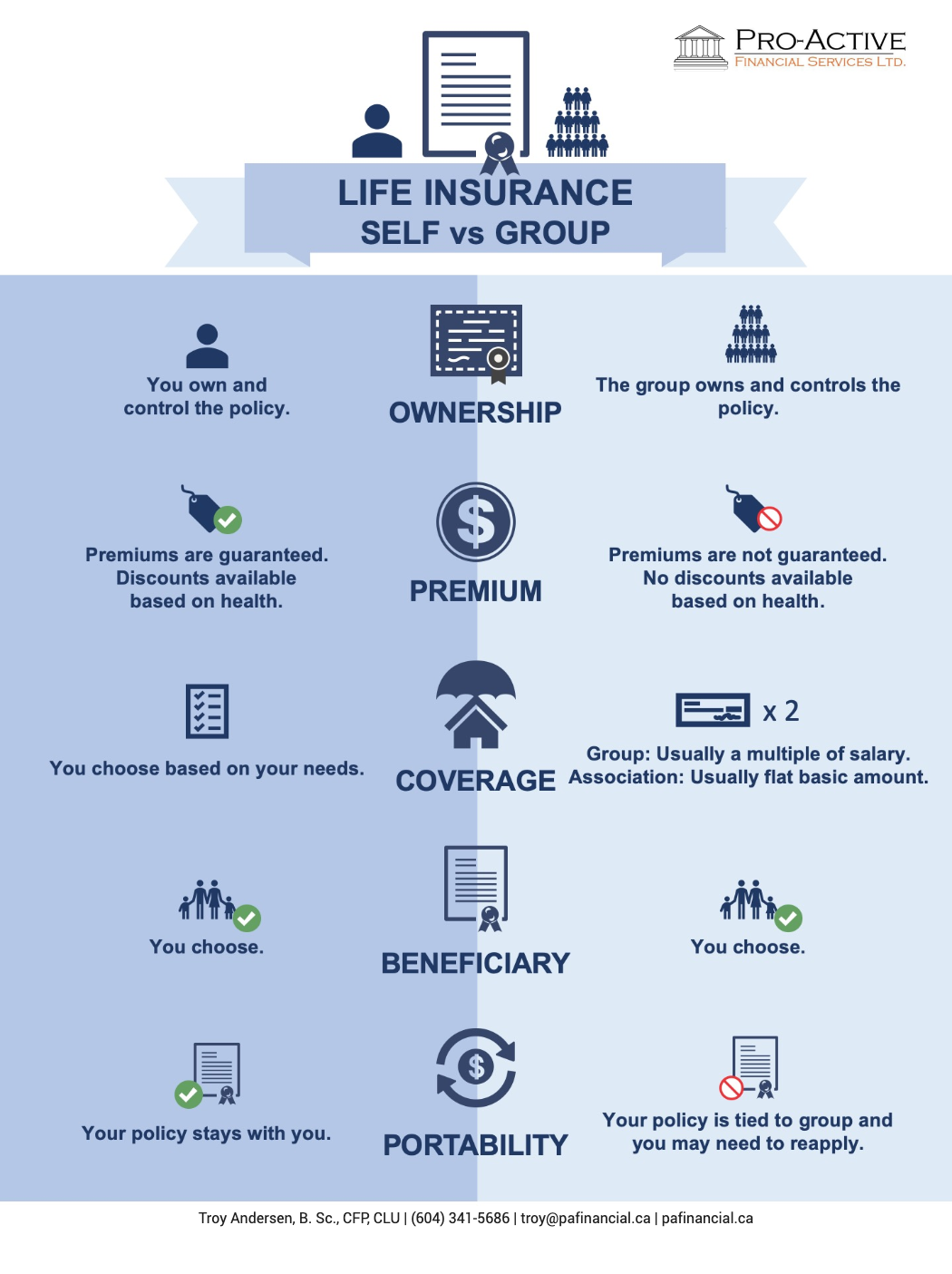

You have two main options when it comes to life insurance – term insurance and permanent life insurance.

With term insurance, you’ve got life insurance coverage for a set period (for example, five years). Premiums for term insurance are lower than for permanent life insurance, but they will rise as you age or your health changes.

With permanent life insurance, you’ve got lifetime coverage. You’ll pay more in premiums at first, but the cost will be less overall than if you buy term insurance for your entire life. Some permanent life insurance policies also allow you to contribute money beyond your premiums, where it can grow tax-free.

Not sure which type is best for you? We can help you figure this out!

Critical Illness Insurance

With critical illness insurance, you will be eligible for a tax-free lump sum of money if you’re diagnosed with a significant illness such as cancer or a stroke. While anyone can benefit from this insurance, it’s essential for self-employed people who don’t have employee benefits to help tide them over while recovering or receiving treatment.

You can spend the lump sum any way you want, including paying off your mortgage, paying for treatment not covered by provincial health care, or putting aside money for your children’s future.

Depending on the type of critical illness policy you select, you may be able to get a “return of premium” option, which means your premiums will be returned to you if you never make a claim. We can explain how to option works and what coverage we think is best for you.

Disability Insurance

Most people assume that they’ll never become disabled. But the stark reality is that 1 in 5 Canadians are considered to be living with a disability. If you couldn’t work anymore because you became disabled, this could have a disastrous impact on your family’s financial stability – especially if you’re self-employed.

With disability insurance, you’ve got financial protection to ensure you can pay your bills and maintain your family’s standard of living. We can explain how to minimize the cost of your premiums while still getting the coverage you need.

Protect Your Family

Book a meeting with us today to get started with insurance planning.