When and Why You Should Conduct an Insurance Audit

As our lives grow and change with variable circumstances, new additions, and job transitions, our needs for insurance will also evolve. Additionally, economic fluctuations and external circumstances that influence your insurance policy will need frequent re-evaluation to ensure that you are making the most appropriate and financially favorable decisions. Perhaps you aren’t sure whether you should conduct an insurance audit or not. The following scenarios are usually a good indication that you should thoroughly assess and review your current policy contract:

-

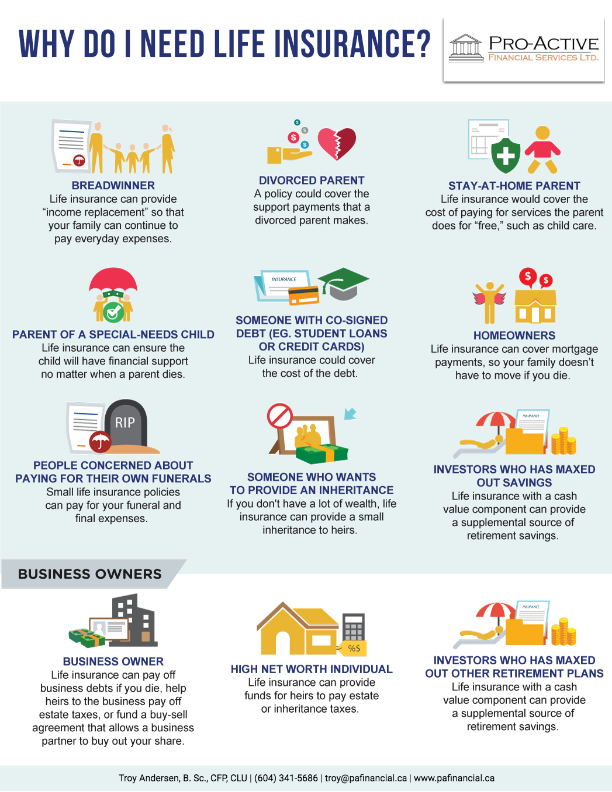

Bringing new life into your family? A new baby may not only prompt you to adjust your beneficiary information, but it is likely to change or influence your coverage needs.

-

Changing jobs? Probationary periods may not provide the same level of disability or accident insurance.

-

Is your policy nearing the end of its term? Be sure to compare prices for new policies as they can sometimes be more affordable as compared to renewing the current plan.

-

Has your marital status changed? Your insurance policy will likely need updating to reflect such.

The specific type of insurance policy you carry as well as personal details certainly influence coverage and premium prices, so if any of the following factors apply to you, be sure to update your policy accordingly. You might be eligible for a rate reduction.

-

Changes to your overall risk assessment like smoking cessation, dangerous hobbies, high risk profession etc.

-

If you have experienced improvements to a previously diagnosed health condition.

-

Do your policy’s investment options still fall in line with current market conditions?

-

Have you used your insurance policy as collateral for a loan? Once that loan is paid off, collateral status should be taken off the policy.

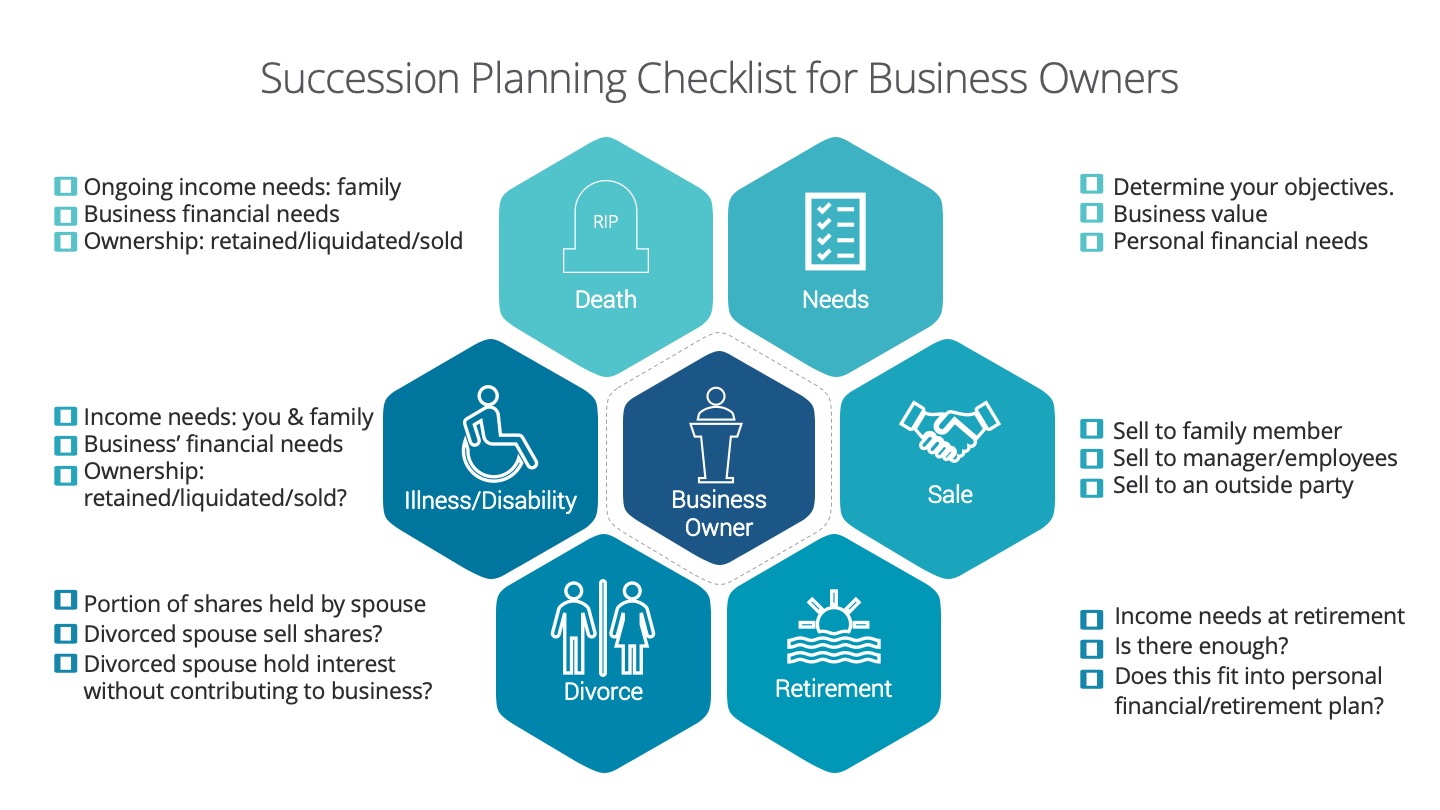

Insurance policies generated for business purposes should also be regularly reviewed to make sure the policy still offers adequate coverage to meet the needs of the company and includes the appropriate beneficiary information. With life happening so quickly, it can be easy to forget about keeping insurance policies up to date, however, major changes can have a profound impact on coverage and premiums. Be sure to conduct insurance audits often to ensure your policies are still meeting your needs.

Contact us to see how we can help.