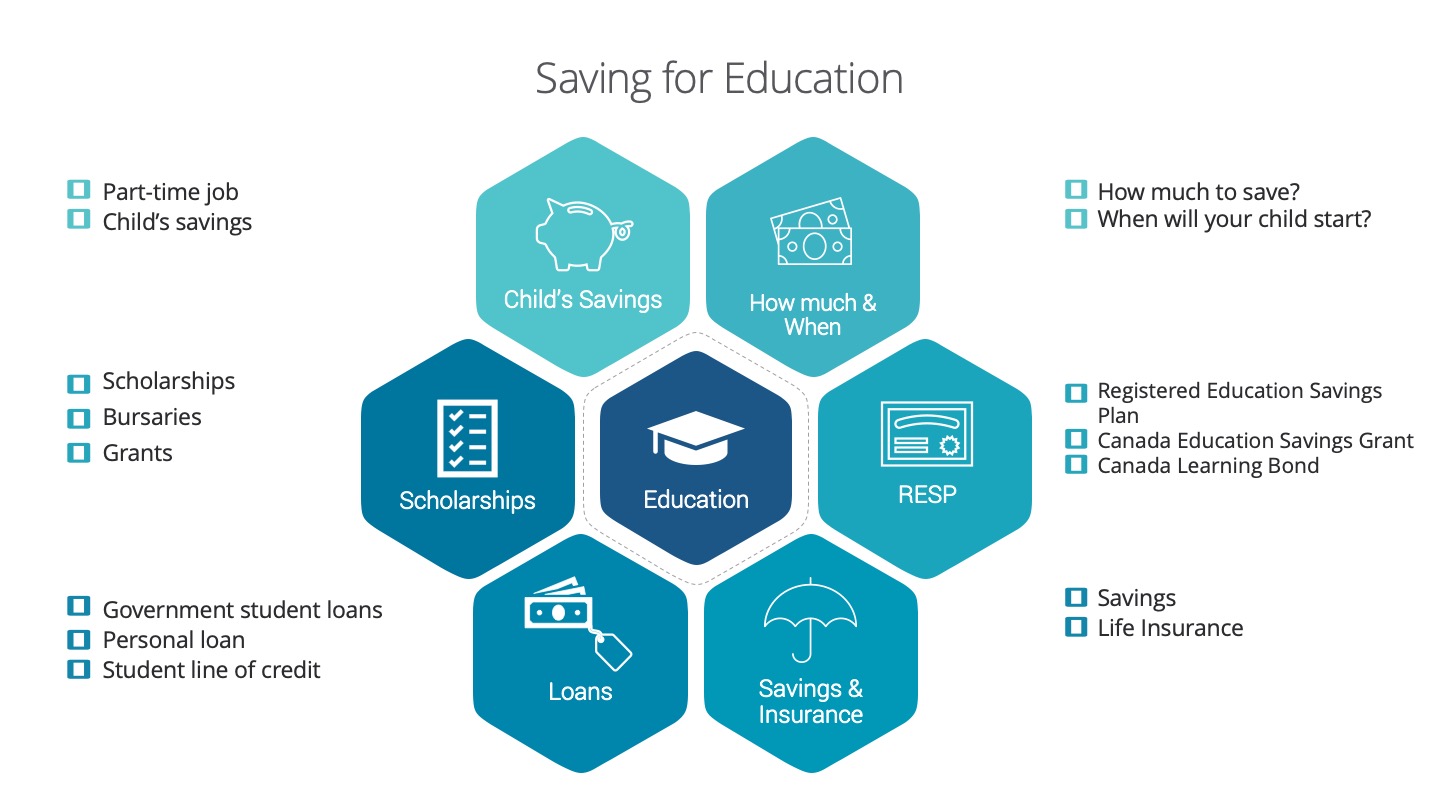

Saving for Education

Post-secondary education can be expensive, however, having the opportunity to plan for it helps with making sure that you’re capable to meet the costs of education. In addition, when you have a plan, it’s easier to make financial decisions that align with your goals and provide peace of mind. In the infographic checklist, we outline 6 factors to consider when paying for education:

For parents:

-

How much to save and when will your child start school?

-

Registered Education Savings Plan – have you set up a family RESP plan and received the Canadian Education Savings Grant? If your income is low enough, you could qualify for the Canada Learning Bond.

-

Savings- are you saving separately for your child’s education? Cash Value Life Insurance- have you considered using this as a savings vehicle for your child’s education. What happens if your child decides not to go to school? These alternative savings vehicles provide flexibility so that you can use the funds for something else such as a down payment for a future home.

For children:

-

Will the child be working part-time and have their own savings for school?

-

Can the child apply for scholarships, bursaries or grants?

-

Will they need to apply for government student loan, personal loan or personal line of credit?

If you need help planning to save for your child’s post-secondary education, contact us!