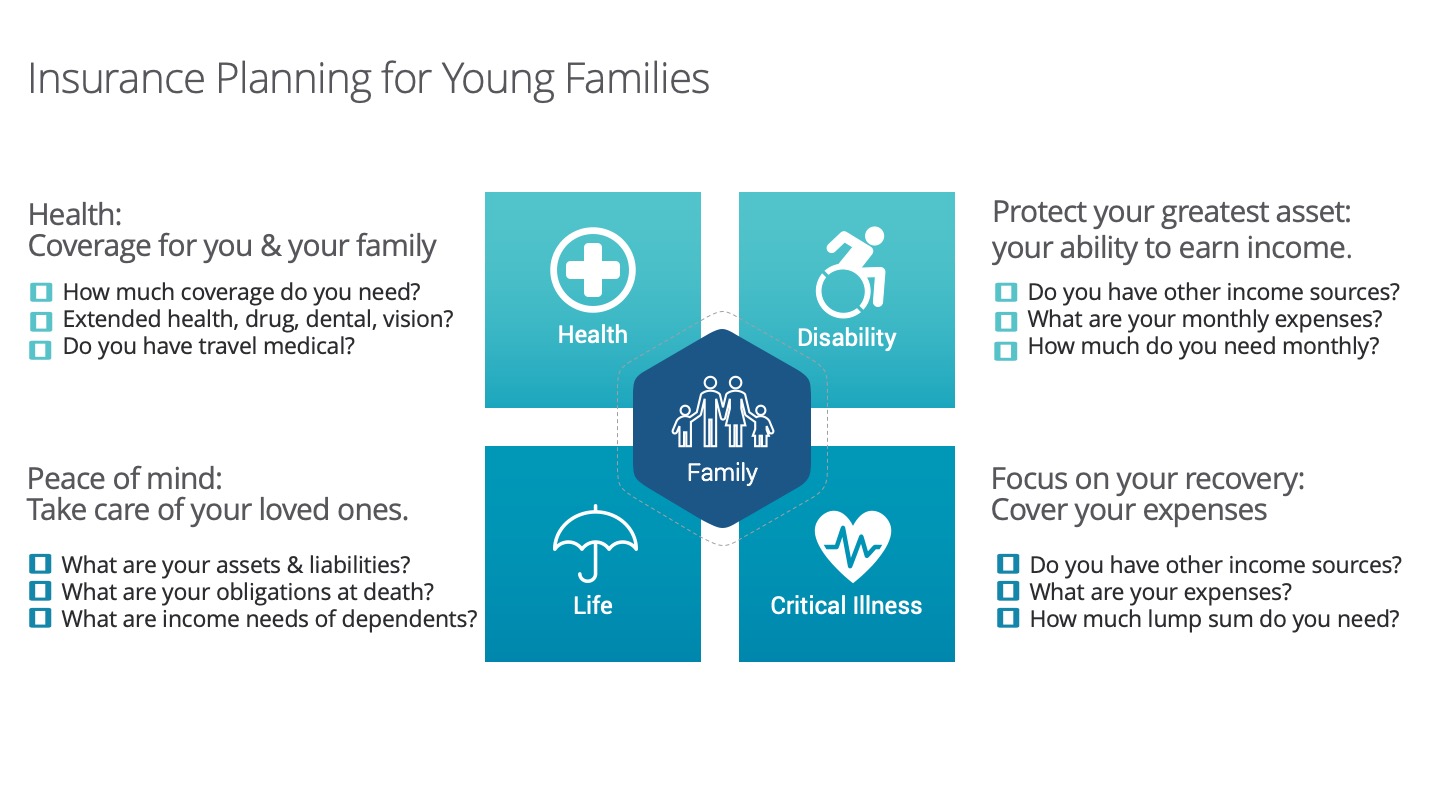

Insurance Planning for Young Families

For young families, making sure your family is financially protected can be overwhelming, especially since there’s so much information floating online. This infographic addresses the importance of insurance- personal insurance.

The 4 areas of personal insurance a young family should take care of are:

-

Health

-

Disability

-

Critical Illness

-

Life

Health: We are so fortunate to live in Canada, where the healthcare system pays for basic healthcare services for Canadian citizens and permanent residents. However, not everything healthcare related is covered, in reality, 30% of our health costs* are paid for out of pocket or through private insurance such as prescription medication, dental, prescription glasses, physiotherapy, etc.. Moreover, if you travel outside of Canada, medical emergencies can be extremely expensive.

Disability: Most people spend money on protecting their home and car, but many overlook protecting their greatest asset: their ability to earn income. Unfortunately one in three people on average will be disabled for 90 days or more at least once before age 65. Disability insurance can provide you with a portion of your income if you were to become disabled and unable to earn an income.

Critical Illness: For a lot of us, the idea of experiencing a critical illness such as a heart attack, stroke or cancer can seem unlikely, but almost 3 in 4 (73%) working Canadians know someone who experience a serious illness. Sadly, this can have serious consequences on you and your family, with Critical Illness insurance, it provides a lump sum payment so you can focus on your recovery.

Life: For young families, if your loved ones depend on you for financial support, then life insurance is absolutely necessary, because it replaces your income, pay off your debts and provides peace of mind.

Talk to us about helping making sure you and your family are protected.