Tax Loss Selling

Over the last few weeks, the financial market has taken a downturn amidst fears over Coronavirus.

Understandably, you are concerned with your portfolio, it’s important to stay level-headed to avoid making financial missteps. However, staying level-headed doesn’t necessarily mean you sit there and do nothing. In fact, one consideration you can look is taking an active tax management approach.

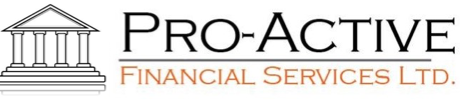

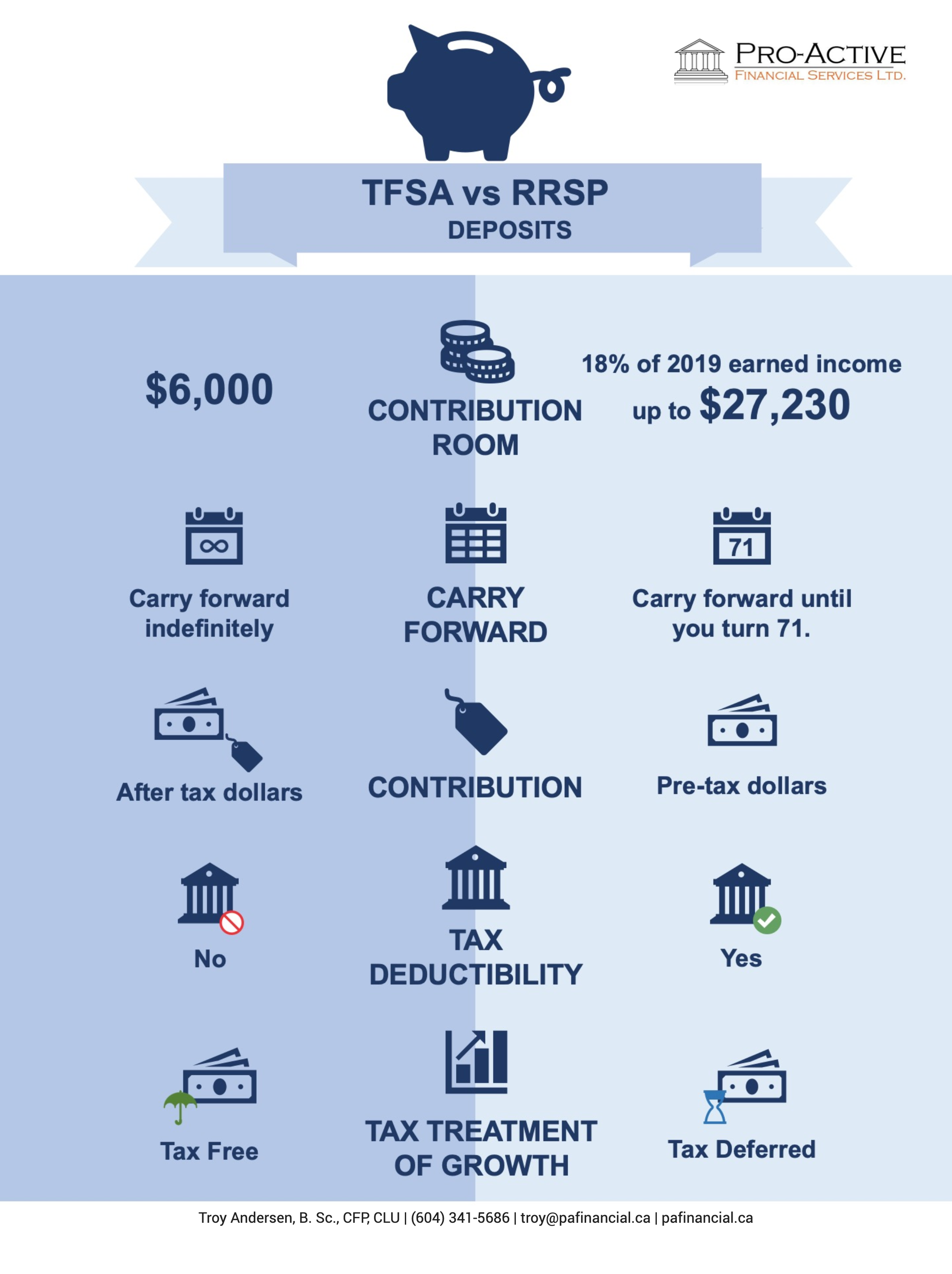

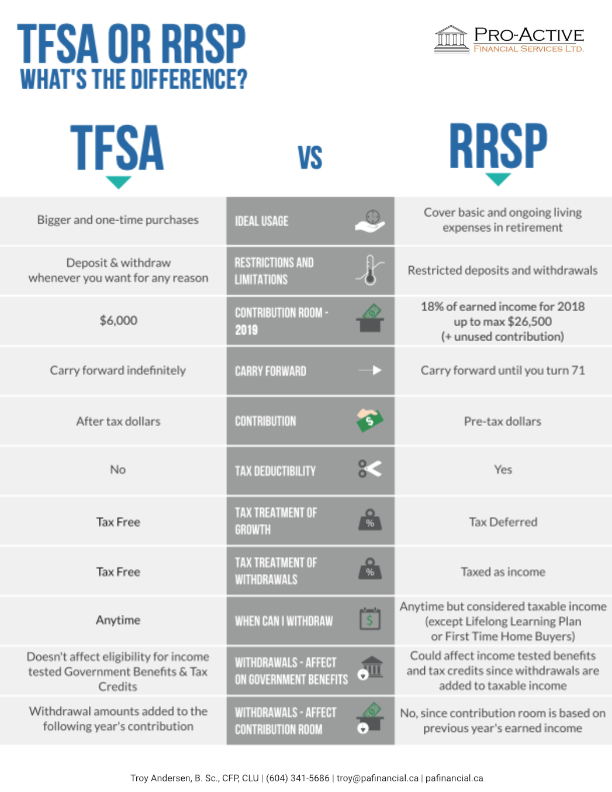

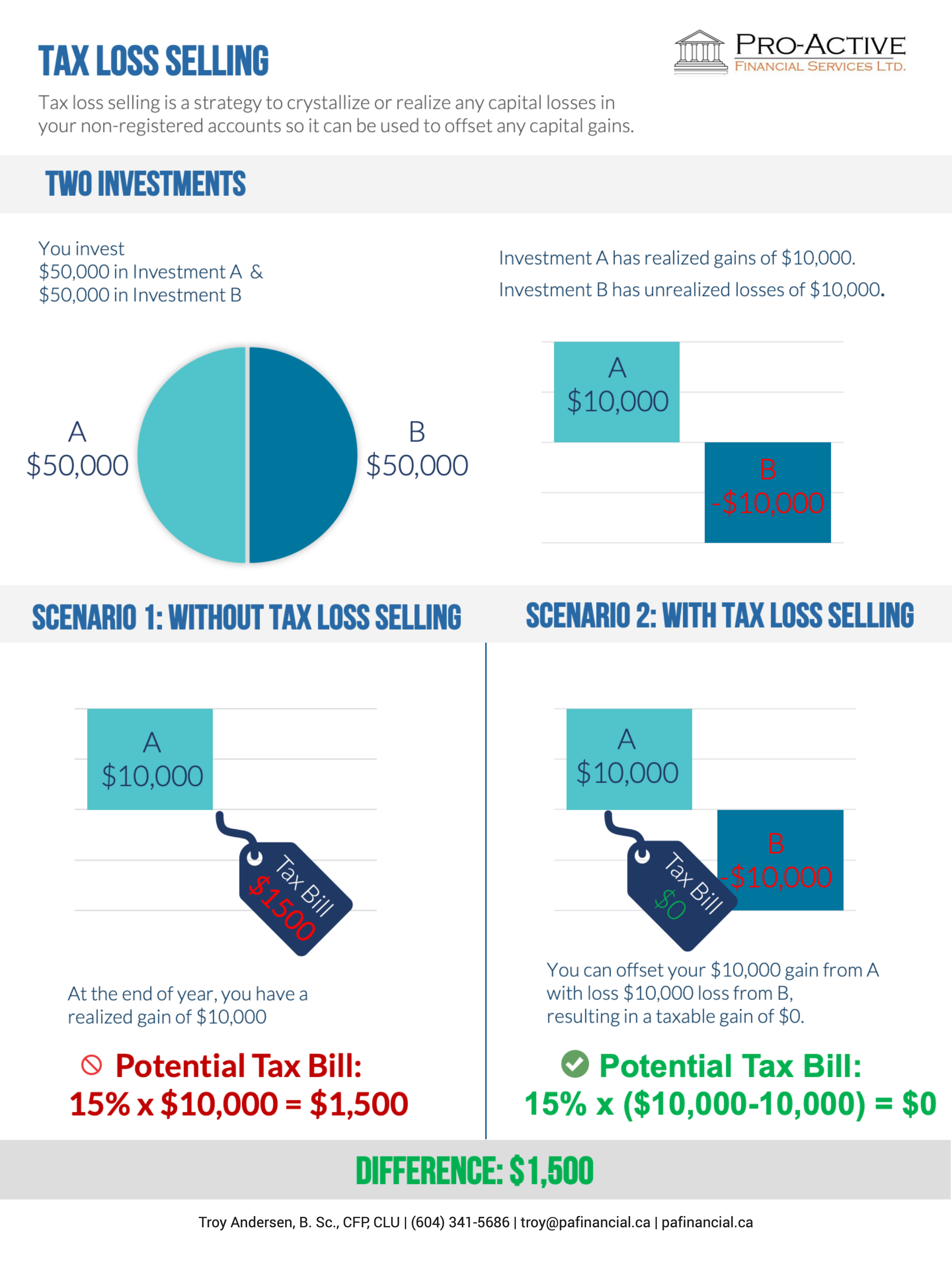

Tax loss selling is a strategy to crystallize or realize any capital losses in your non-registered accounts so it can be used to offset any capital gains. There is no benefit to selling in your tax free savings account (TFSA) or registered retirement savings plan (RRSP).

You can apply capital losses back 3 years or carry them forward indefinitely, therefore we’ve outlined several situations that make sense for tax loss selling.

To better understand how tax-loss selling works, imagine a scenario in which someone invests $100,000, putting $50,000 in “Investment A” and $50,000 in “Investment B.”

At the end of one year, Investment A has risen by $10,000 and is now worth $60,000. Investment B has declined by $10,000 and is now worth $40,000.

Without tax-loss selling, the investor has a realized gain of $10,000 from Investment A, and has a potential tax bill of $1,500 (assuming he or she sells the shares and pays the 15% capital gains tax on the profit).

On the other hand, with tax-loss selling, selling Investment B to offset gains from Investment A. At the end of the year, instead of paying a $1,500 tax, the investor only has a potential tax bill of $0, for a potential tax savings of $1,500.

With the investor’s tax liability reduced by $1,500, that savings becomes money that can be invested back in the portfolio, used to maximize RRSP contributions, pay off debt, or spend as one pleases.

What Situations make sense for tax loss selling?

-

If you have an investment with a considerable capital gain, review through your current investments to see if there are any investments to sell at a loss.

-

Receiving a tax refund for a previous year. Keep in mind, you can apply capital losses back 3 years, therefore if you sold a property within the last 3 years for a considerable gain and paid the tax. This year, you could sell other investments at a loss and apply them back and get some tax paid back.

-

For tax deferral, with tax losses you can apply these losses back 3 years or carry them forward indefinitely, therefore you may want to trigger a loss today because if you are planning to sell that property in the next year or so, it may rebound and therefore you will lose the chance to offset the gains.

-

Lastly, you may have an investment in your portfolio that’s a dud. It might be time to move on and put your money into a different investment so that you can apply the loss in the future.

Tax Loss Selling is Complicated

There are specific conditions required by CRA that must be met in order for this strategy to work such as making sure your loss is not declared a “superficial loss” (these rules are very restrictive). A superficial loss is when you sell and trigger a capital loss, you cannot deduct the loss if you or an affiliate purchase an identical security within 30 days before or after your settlement date.

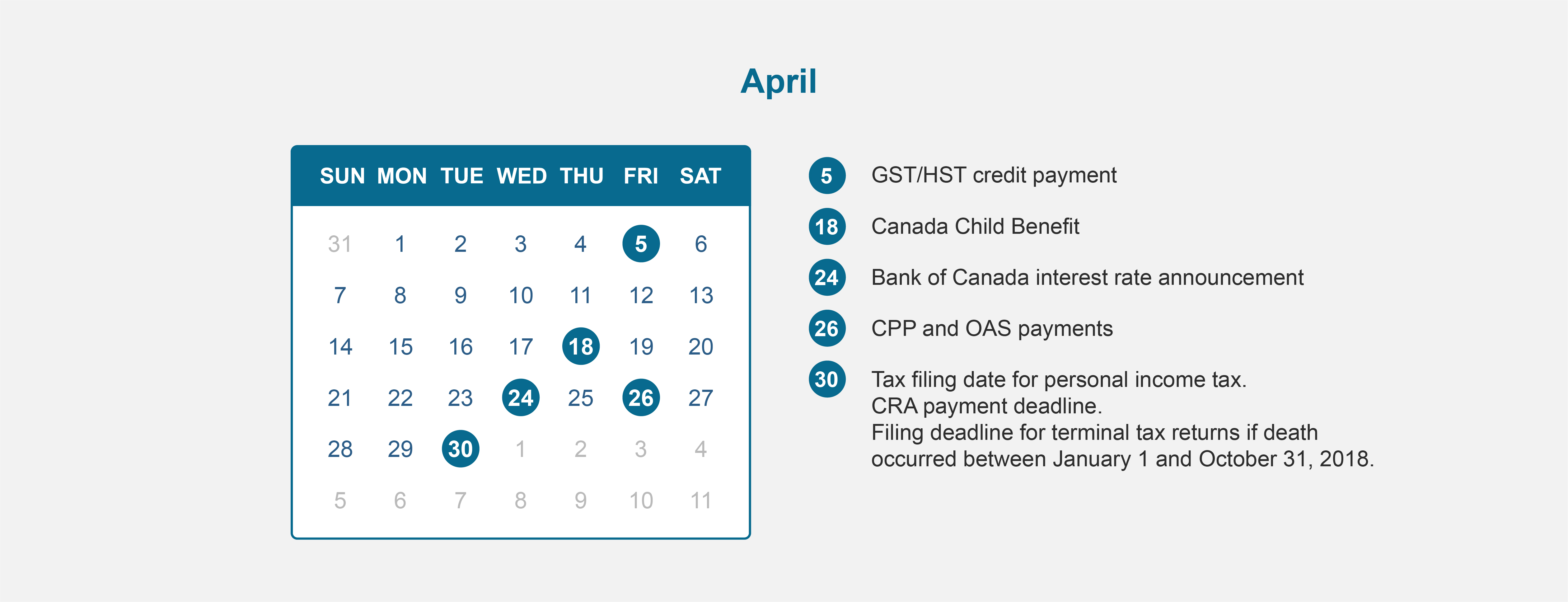

Another condition is that the sale of assets is prior to the year-end deadline (this varies by calendar year). You also need to make sure you have accurate information on the adjusted cost base (ACB) of your investment. When you file your taxes, any losses must be first used to offset capital gains in the current tax year, then any remaining losses can be carried back.

Before engaging in tax loss selling, you should contact us directly so we can make the strategy works for you.