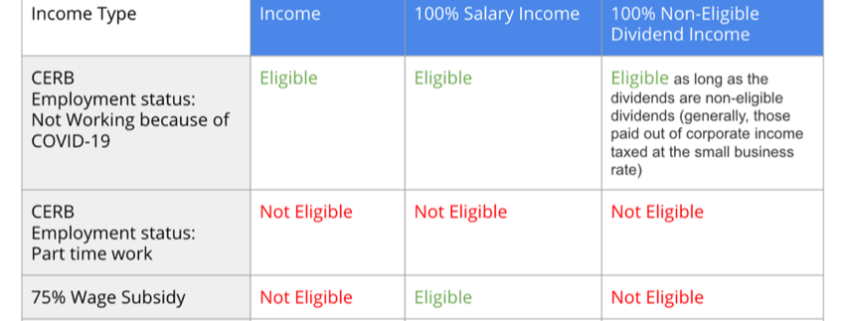

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more

/in 2020 Only, blog, Business Owners/by Pro Active Financial Services Ltd.March 27, 2019 – Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”

Wage Subsidy increased to 75%

The Prime Minister has been under pressure from the small business community to boost the wage subsidy beyond the 10% initially announced to help keep people employed. Today, Mr. Trudeau announced the government will increase the wage subsidy from 10% to 75% to help keep employees on the payroll. This increase will be backdated to Sunday, March 15th.

“It is clear we have to do more, much more so we are bringing that percentage up to 75 per cent for qualifying businesses”

– Prime Minister Justin Trudeau

Canada Emergency Business Account (CEBA)

The CEBA will allow banks to offer $40,000 loans that will be interest-free for the 1st year which will be guaranteed by the government. If you meet certain conditions, $10,000 of the loan can be forgivable.

“To help you bridge to better times, we are launching the Canada Emergency Business Account. With this new measure banks will soon offer $40,000 which will be guaranteed by the government”

Defer GST, HST, Duty

The government will defer GST & HST payments, as well as duty and taxes owed on imports until June 2020.

“This is the equivalent of giving $30-billion of interest free loans to businesses”

Bank of Canada Rate Cut

Bank of Canada slashed its key overnight interest rate to 0.25%.

Full details and qualification requirements will be available on Monday.

Salary vs Dividend

/in blog, Business Owners/by Pro Active Financial Services Ltd.As a business owner, you have the ability to pay yourself a salary or dividend or a combination of both. In this article and infographic, we will examine the difference between salary and dividends and review the advantages and disadvantages of each.

When deciding to pay yourself as a business owner, please review these factors:

-

How much do you need?

-

How much tax?

-

Other considerations including retirement and employment insurance.

How much do you need?

Determine your cash flow on a personal and corporate level.

-

What’s your personal after-tax cash flow need?

-

What’s your corporate cash flow need?

How much tax?

Figure out how much you will pay in tax. Business owners understand that tax is a sizeable expense.

-

What’s your personal income tax rate?

Depending on the province you reside in and your income, make sure you also include income from other sources to determine your tax rate. (Example: old age security, pension, rental, investment income etc.)

If you decide to pay out in dividends, check if you will be paying out eligible or ineligible dividends. The taxation of eligible dividends is more favorable than ineligible dividends from an individual income tax standpoint.

-

What’s your corporation’s income tax rate?

For taxation year 2020, the small business federal tax rate is 9% . Please also remember, if you pay out salary, salary is considered a tax-deductible expense, therefore this will lower the corporation’s taxable income versus paying out dividends will not lower the corporation’s taxable income.

Other considerations

If you pay yourself a salary, these options are available.

-

Do you need RRSP contribution room?

As part of this, it’s worth considering ensuring that you receive a salary high enough to take full advantage of the maximum RRSP annual contribution that you can make.

-

Are you interested in contributing to the Canada Pension Plan?

This is unique to your circumstances and a cost-benefit analysis to determine the amount of contributions makes sense.

-

Do you need employment insurance (EI)?

For shareholders owning more than 40% of voting shares, EI is optional . There are situations worth careful thought such as maternity benefit, parental benefit, sickness benefit, compassionate care benefit, family caregiver benefit for children or family caregiver benefit for adults.

The infographic below summarizes the difference between Salary vs. Dividend.

We would also advise that you get in touch with your accountant to help you determine the best mix for your unique situation.

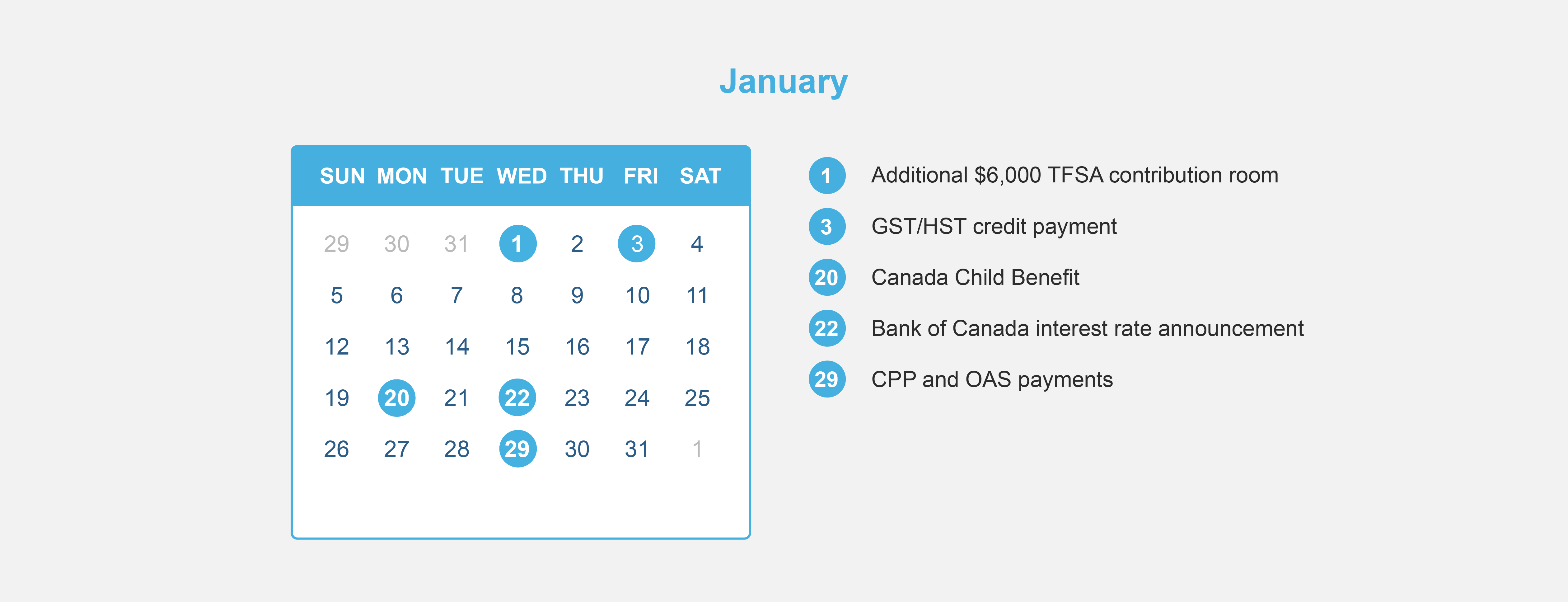

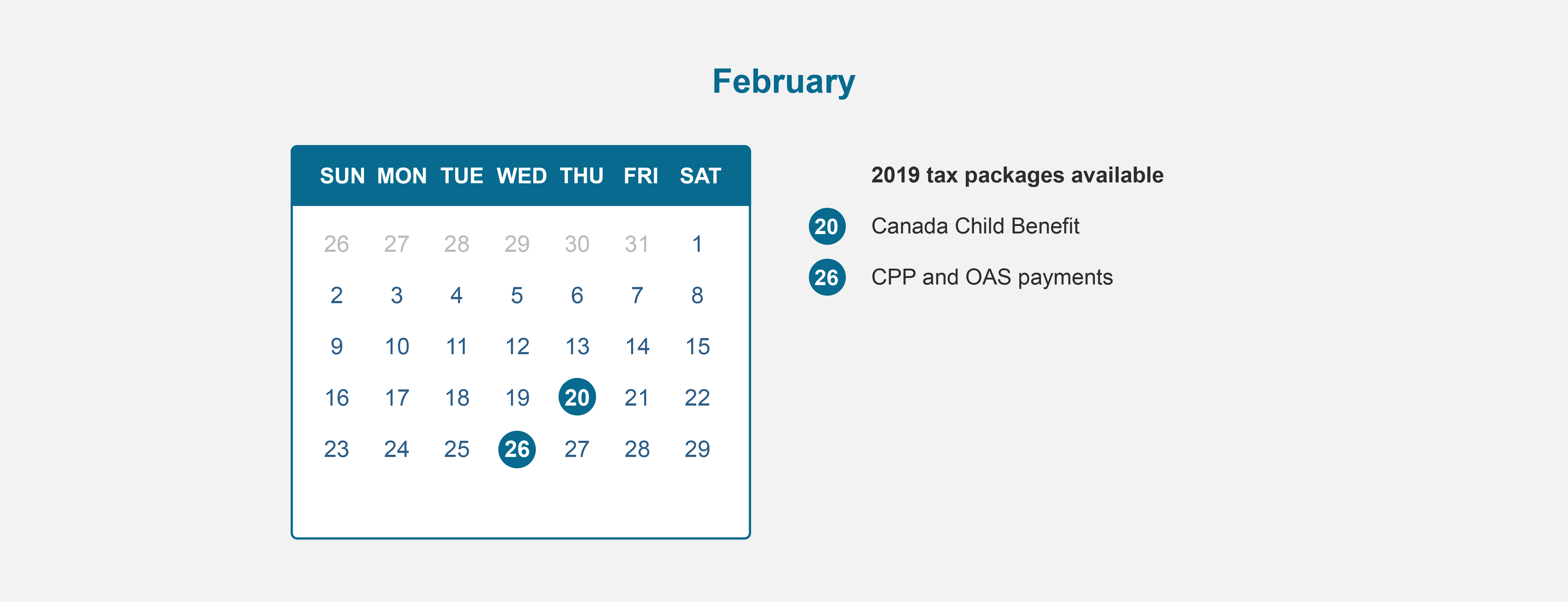

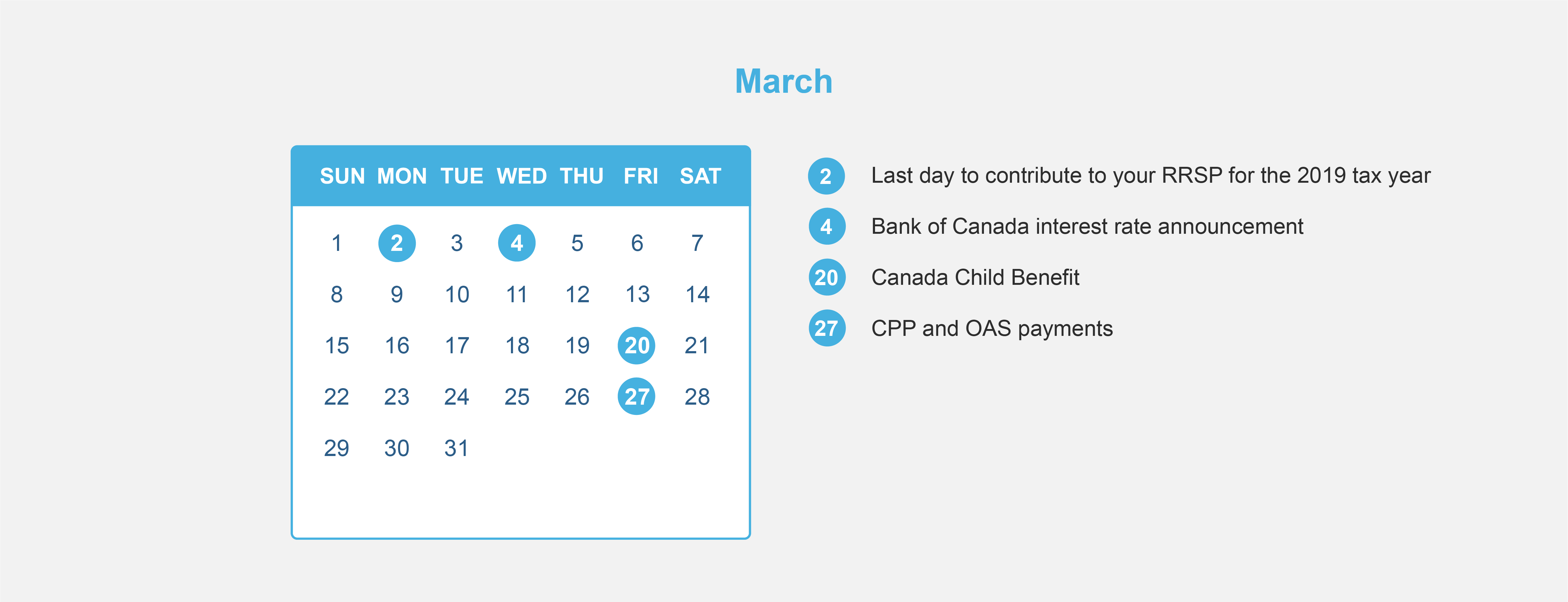

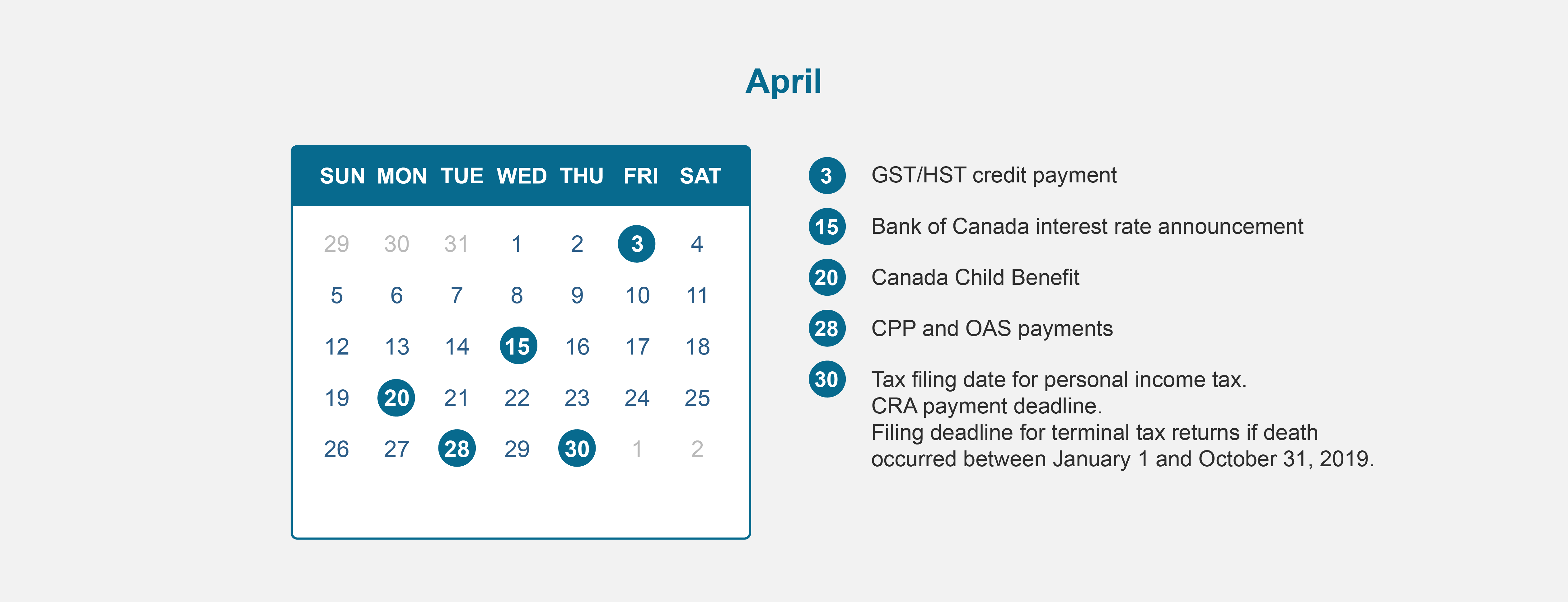

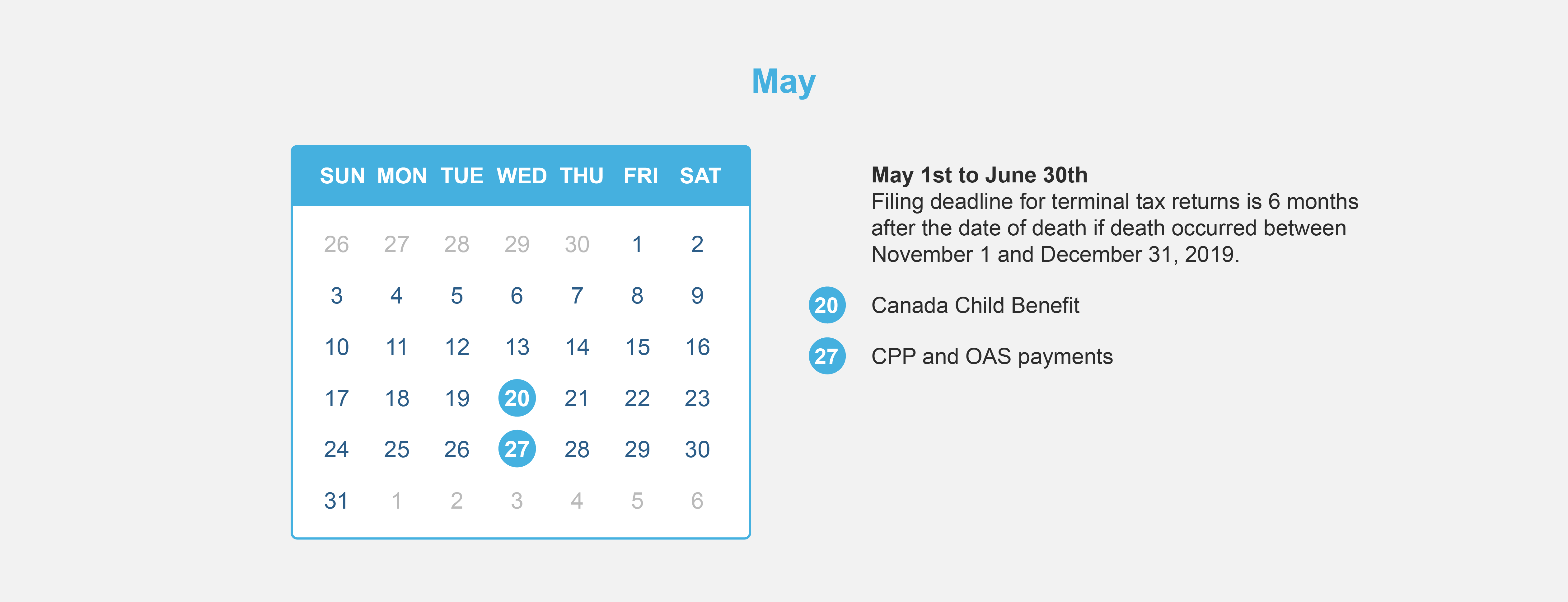

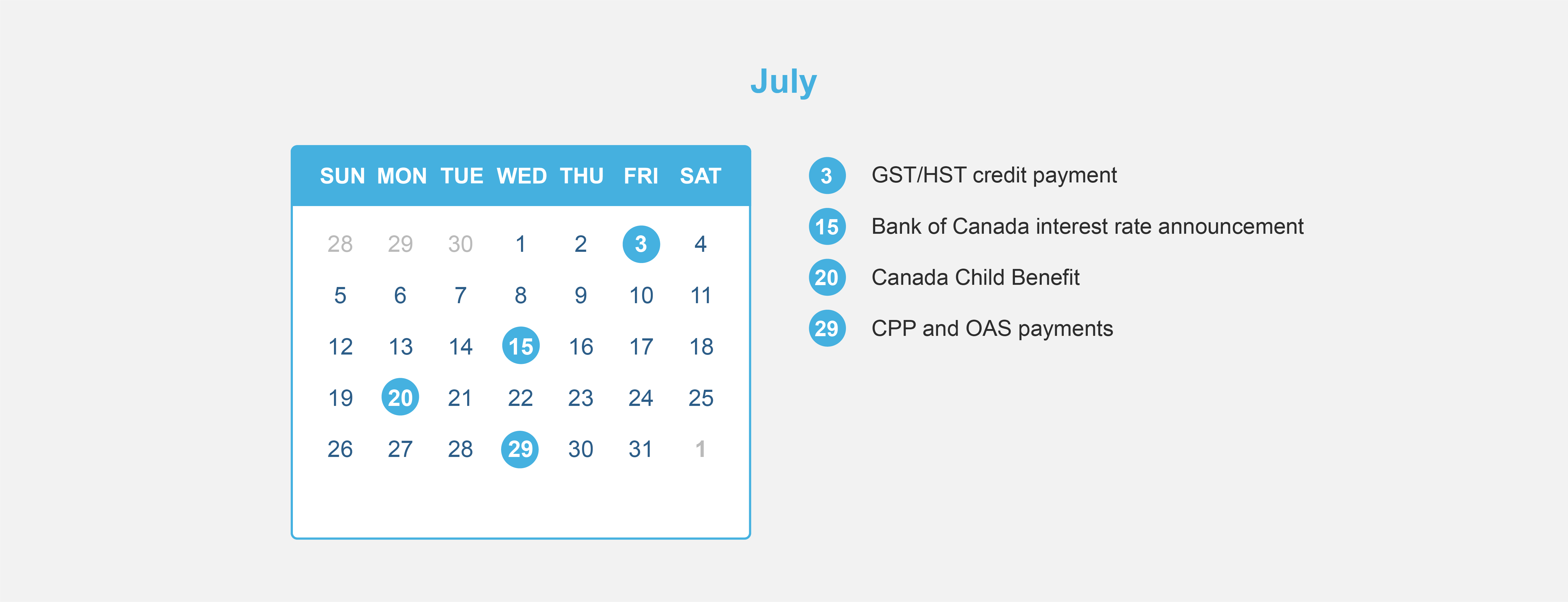

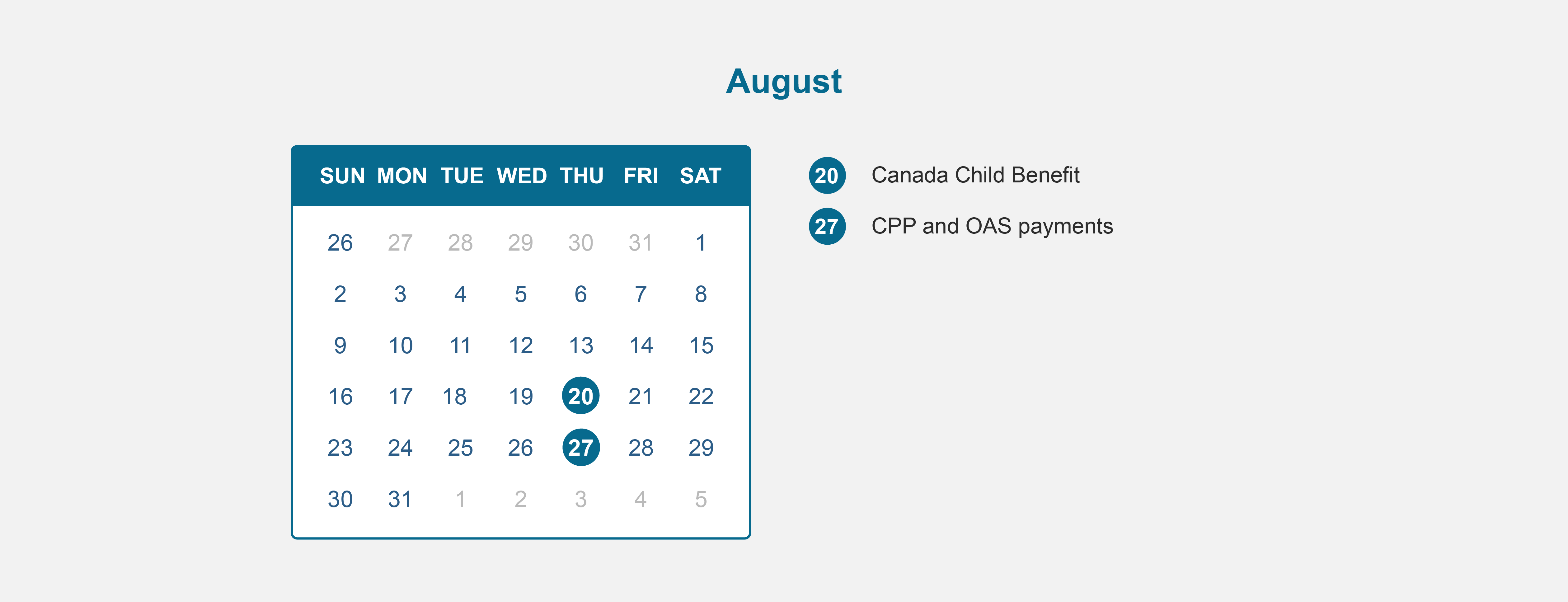

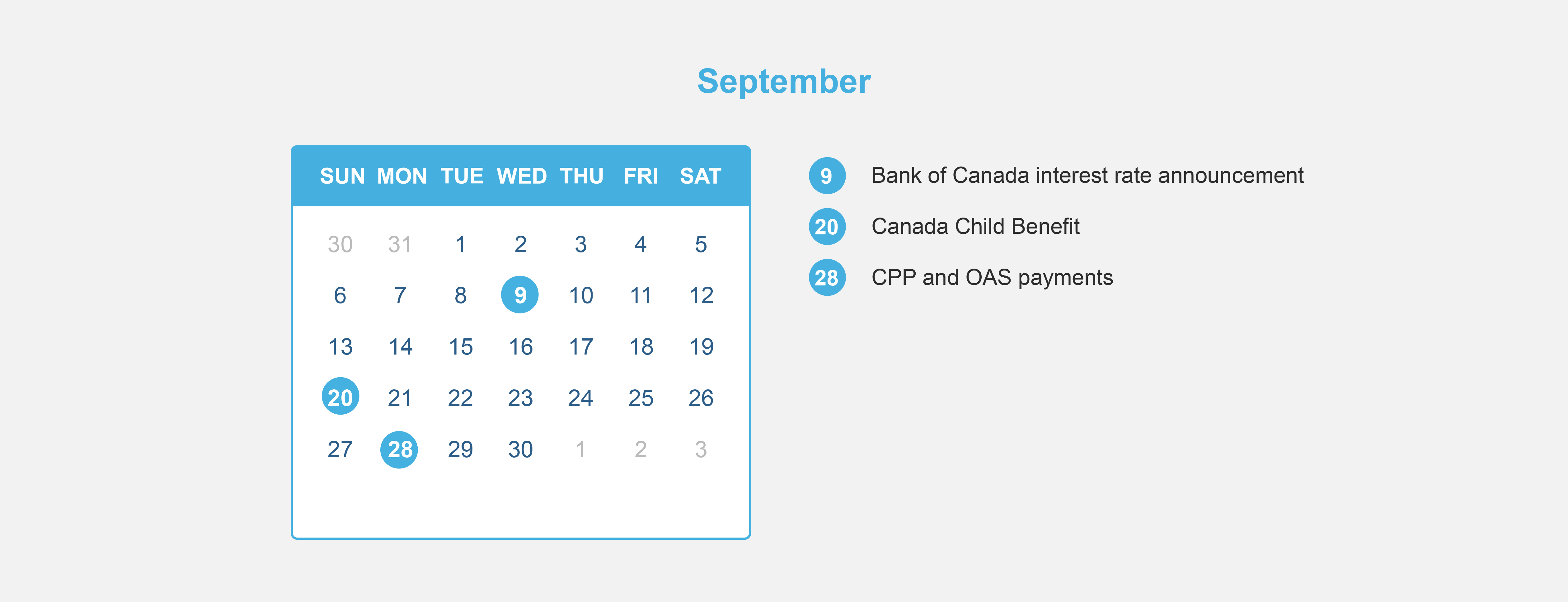

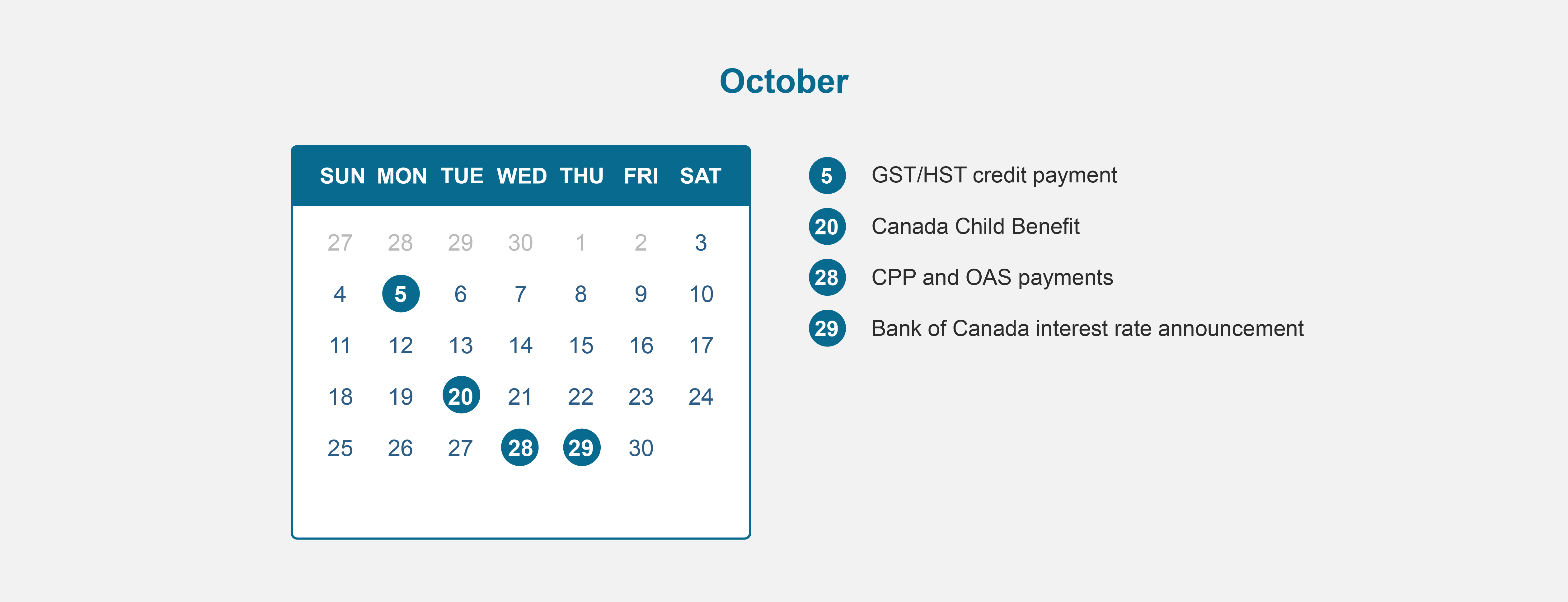

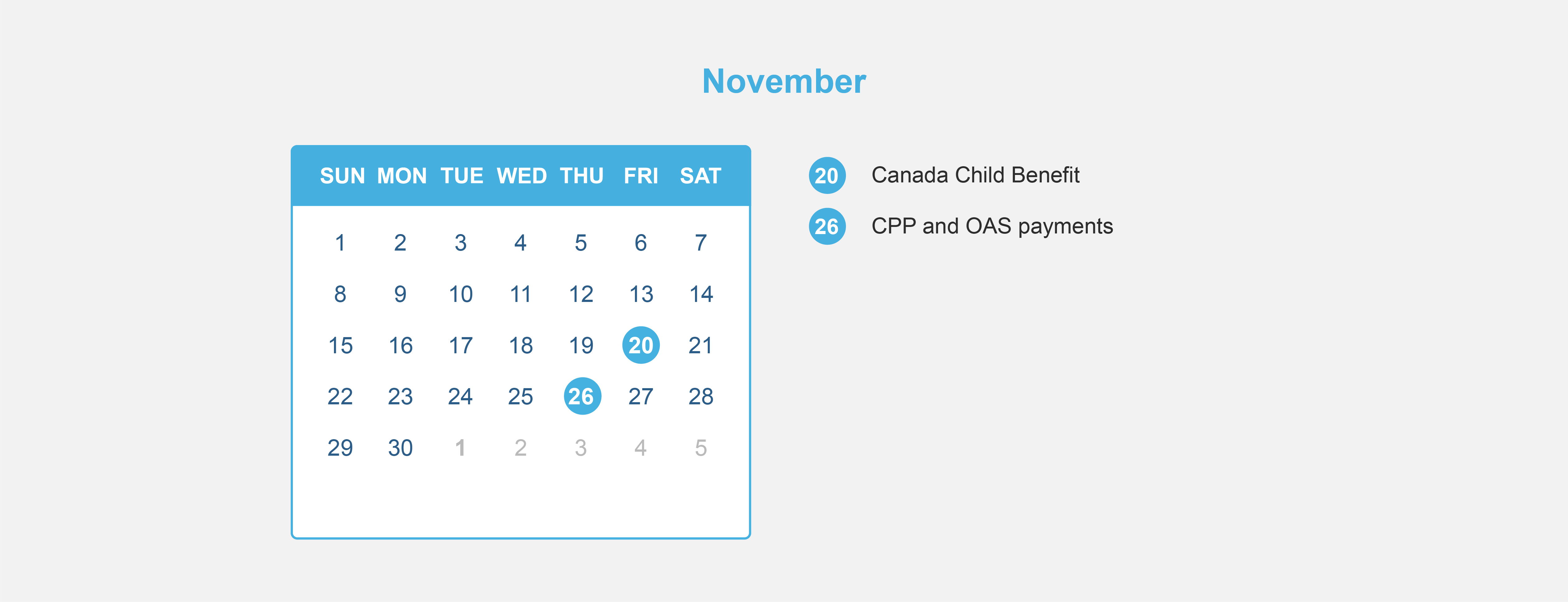

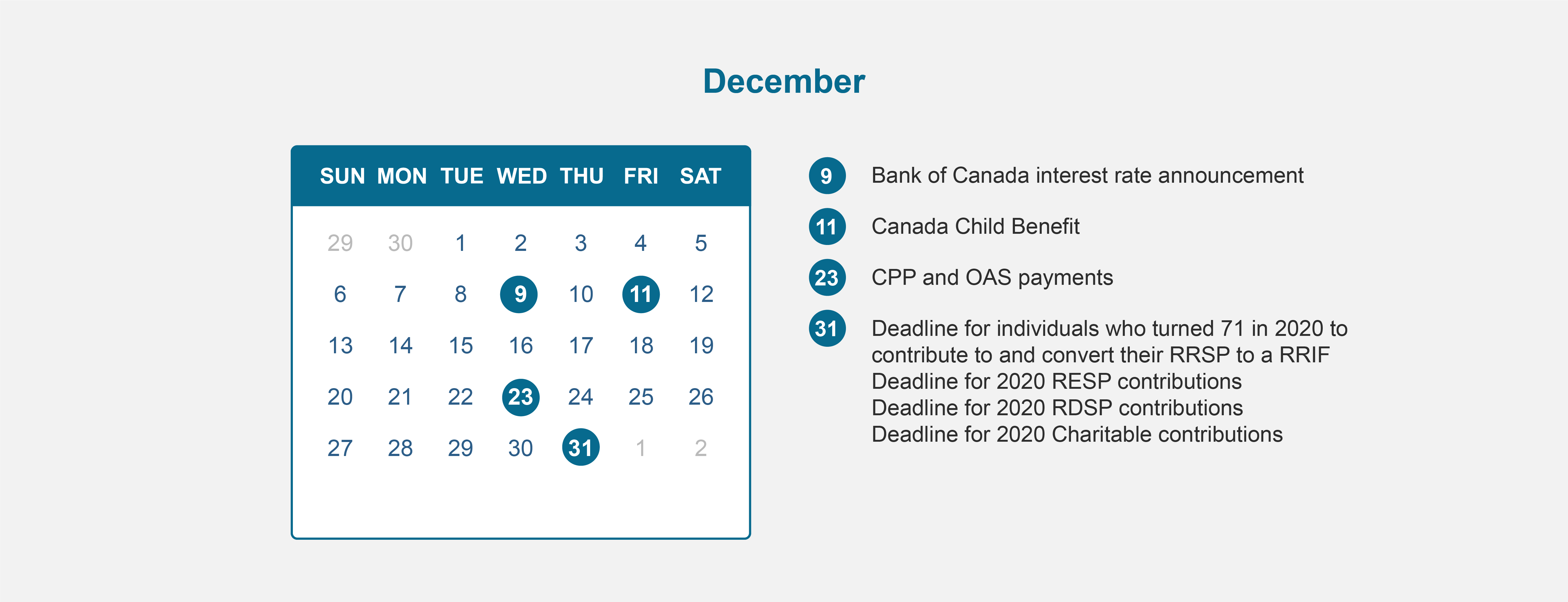

2020 Financial Calendar

/in blog, Business Owners, corporate, Individuals, Investment, RRSP, tax, Tax Free Savings Account/by Pro Active Financial Services Ltd.2020 Financial Calendar

Financial Calendar for 2020 – All the dates you need to know to maximize your benefits!

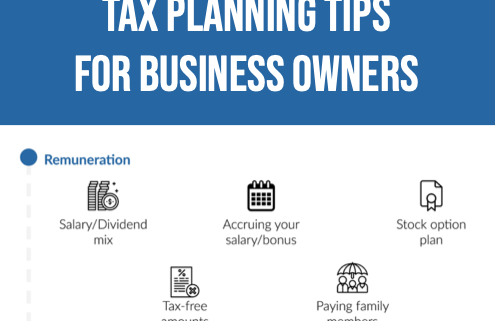

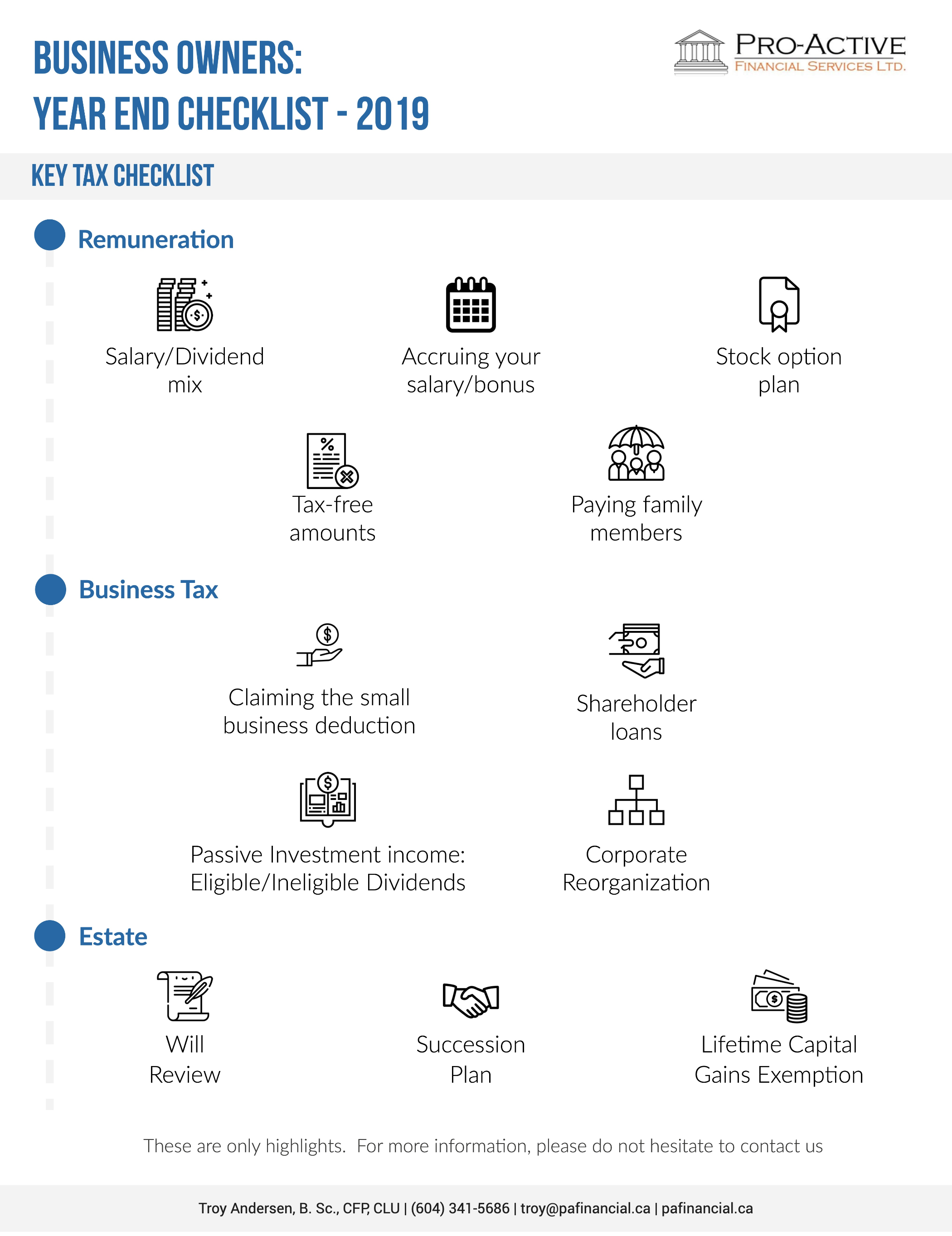

Business Owners: 2019 Tax Planning Tips for the End of the Year

/in blog, Business Owners, life insurance/by Pro Active Financial Services Ltd.

Now that we are nearing year end, it’s a great time to review your business finances. With the federal election over and no major business tax changes for this year, 2019 is a good year to make sure you are effectively tax planning. Please keep in mind that your business may be affected by the recent tax on split income (TOSI) and the passive investment income rules given they came into effect in 2018. These rules can be complicated, please don’t hesitate to consult us and your accountant to determine how this can affect your business finances.

We are also assuming that your corporate year end is December 31, however if it’s not, this is useful when your business year end comes up.

Below, we have listed some of the key areas to consider and provided you with some useful guidelines to make sure that you cover all of the essentials. We have divided our tax planning tips into 4 sections:

-

Tax checklist

-

Remuneration

-

Business tax

-

Estate

1) Business Year-End Tax Checklist

Remuneration

☐ Salary/Dividend mix

☐ Accruing your salary/bonus

☐ Stock option plan

☐ Tax-free amounts

☐ Paying family members

Business Tax

☐ Claiming the small business deduction

☐ Shareholder loans

☐ Passive investment income: eligible/ineligible dividends

☐ Corporate reorganization

Estate

☐ Will review

☐ Succession plan

☐ Lifetime capital gains exemption

2) Remuneration

What’s your salary/dividend mix?

Individuals who own incorporated businesses can elect to receive their income as either salary or as dividends. Your choice will depend on your own situation consider the following factors:

-

Your current and future cash flow needs

-

Your personal income level

-

The corporation’s income level

-

TOSI rules

-

Passive investment income rules

Please also consider the difference between salary and dividends:

Salary

✓ Provides RRSP contribution

✓ Reduces corporate tax bill

• Payroll tax

• Canada Pension Plan (CPP) contribution

• Employment Insurance contribution

Dividend

• Doesn’t provide RRSP contribution

• Doesn’t reduce corporate tax bill

• No tax withholdings

• No Canada Pension Plan contribution

• No Employment Insurance contribution

✓ Receive up to $50,000 of ineligible dividends at a low tax rate depending on province

As part of this, it’s worth considering ensuring that you receive a salary high enough to take full advantage of the maximum RRSP annual contribution that you can make. For 2019, salaries of $151,278 will provide the maximum RRSP room of $27,230 for 2020.

Is it worth accruing your salary or bonus this year?

You could consider accruing your salary and / or bonus in the current year but delaying payment of it until the following year. If your company’s year-end is December 31, your corporation will benefit from a deduction for the year 2019 and the source deductions are not required to be remitted until actual salary or bonus payment in 2020.

Stock Option Plan

If your compensation includes stock options, please check if you will be affected by the new proposed stock option rules. This caps the amount of certain employee stock options eligible for the stock option deduction at $200,000 after December 31, 2019. The rules will not affect you if your stock options are granted by a Canadian controlled private corporation.

Tax Free Amounts

If you own your corporation, pay tax-free amounts if you can. Here are some ways to do so:

-

Pay yourself rent if the company occupies space in your home.

-

Pay yourself capital dividends if your company has a balance in its capital dividend account.

-

Return “paid-up capital” that you have invested in your company

Do you employ members of your family?

Employing and paying salary to family members who undertake work for your incorporated business is worth considering as you could receive a tax deduction against the salary that you pay them, providing that said salary is “reasonable” in relation to the work done. In 2019, the individual can earn up to $12,069 and pay no federal tax. This also provides the individual with RRSP contribution room, CPP and allow for child-care deductions. Bear in mind additional costs that are incurred when employing someone, such as payroll taxes and contributions to CPP.

3) Business Tax

Claiming the Small Business Deduction

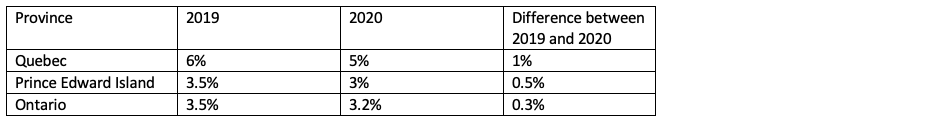

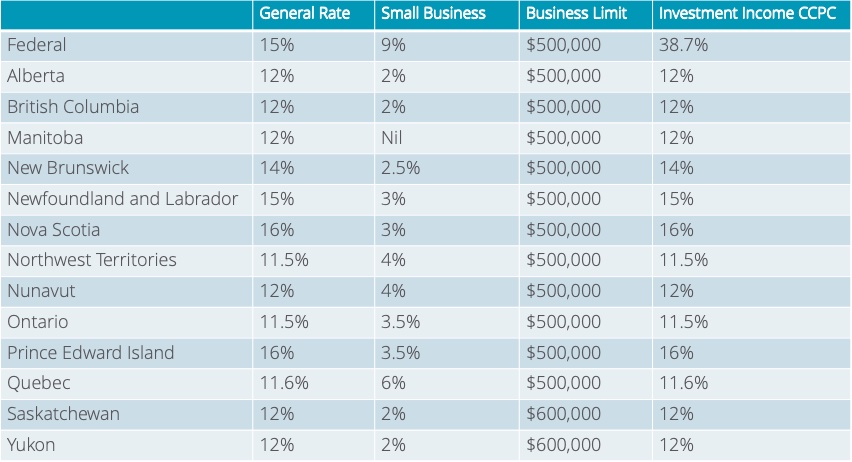

Are you able to claim a small business deduction? The federal small business tax rate decreased from 9% in 2019 (from 10% in 2018) and not anticipated to increase in 2020. From a provincial level, there will be changes in the following provinces:

Small Business Tax Rate

Therefore, a small business deduction in 2019 is worth more than in 2020 for these provinces.

Should you repay any shareholder loans?

Loaning funds from your corporation at a low or zero interest rate means that you are considered to have benefited from a taxable benefit at the CRA’s 2% interest rate, less actual interest that you pay during the year or thirty days after it. You need to include the loan in your income tax return, unless it is repaid within one year after the end of your corporation’s taxation year.

For example, if your company has a December 31st year-end and it loaned you funds on November 1, 2019, you must repay the loan by December 31, 2020, otherwise you will need to include the loan as taxable income in your 2019 personal tax return.

Passive investment income

If your corporation has a December year- end, then 2019 will be the first taxation year that the new passive investment income rules may apply to your company.

New measures were introduced in the 2018 federal budget relating to private businesses which also earn passive investment income in a corporation that also operates an active business.

There are two key parts to this, as follows:

-

Limiting access to dividend refunds. Essentially, a private company will be required to pay ineligible dividends in order to receive dividend refunds on some taxes which, in the past, could have been refunded when an eligible dividend was paid.

-

Limiting the small business deduction. This means that, for the companies mentioned above, the small business deduction can be reduced at a rate of $5 for every $1 over between $50,000 and $150,000 of investment income, or eliminated if investment income exceeds $150,000. Please note that Ontario and New Brunswick have indicated that they will not follow the federal rules.

If your corporation earns both active business and passive investment income, you should contact us and your accountant directly to determine if there are any planning opportunities to minimize the impact of the new passive investment income rules.

Think about when to pay dividends and dividend type

When choosing to pay dividends in 2019 or 2020, you should consider the following:

-

Difference between the yearly tax rate

-

Impact of tax on split income

-

Impact of passive investment income rules

With the exception of 2 provinces, Quebec and Ontario, the combined top marginal tax rates will not be changing from 2019 to 2020 on a provincial level. Therefore, it will not make a difference if you choose to pay in 2019 or 2020.

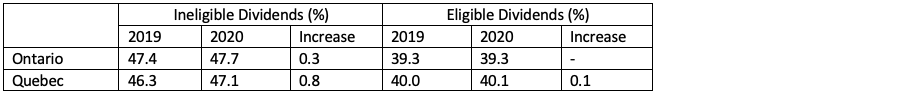

Combined Marginal Tax Rate

In Quebec and Ontario, because there are slight increases in the combined marginal tax rate, there are potential tax savings available if you choose to pay dividends in 2019 rather than in 2020.

When deciding to pay a dividend, you will need to decide to pay out eligible or ineligible dividends, you should consider the following:

-

Dividend refund claim limits: Eligible refundable dividend tax on hand (ERDTOH) vs Ineligible Refundable dividend tax on hand (NRDTOH)

-

Personal marginal tax rate of eligible vs. ineligible dividends

Given the passive investment income rules, typically, it makes sense to pay eligible dividends to deplete the ERDTOH balance before paying ineligible dividends. (Please note that ineligible dividends can also trigger a refund from the ERDTOH account.)

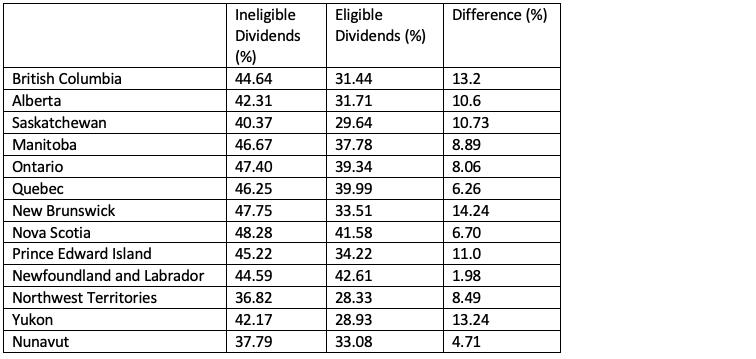

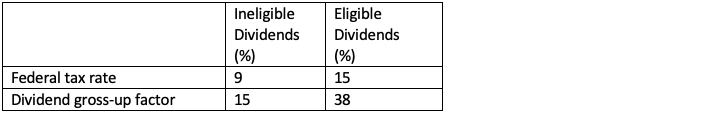

Eligible dividends are taxed at a lower personal tax rate than ineligible dividends (based on top combined marginal tax rate). However, keep in mind, when ineligible dividends are paid out, they are subject to the small business deduction, therefore the dividend gross-up is 15% while eligible dividends that are subject to the general corporate tax rate have a dividend gross-up is 38%. It’s important to talk to a professional to determine what makes the most sense when determining the type of dividend to pay out of your corporation.

Combined Personal Top Marginal Tax Rate on Dividends

Corporate Federal Tax Rate and Gross-up factor

Corporate Reorganization

It might be time to revisit your corporate structure given the changes to private corporation rules on income splitting and passive investment income to provide more control on the distribution of dividend income. Another reason to reassess your structure is to segregate investment assets from your operating company for asset protection. (Keep in mind you don’t want to trigger TOSI, so make sure you structure this properly.) If you are considering succession planning, this is the time to evaluate your corporate structure as well.

4) Estate

Ensure your will is up to date

In particular, if your estate plan includes an intention for your family members to inherit your business, ensure that this plan is tax effective following new tax legislation from January 1, 2016. In addition, review your will to make sure that any private company shares that you intend to leave won’t be affected by the new TOSI rules.

Succession plan

Consider a succession plan to ensure your business is transferred to your children, key employees or outside party in a tax efficient manner.

Lifetime Capital Gains Exemption

If you sell your qualified small business corporation shares, you can qualify for the lifetime capital gains exemption (In 2019, the exemption is $866, 912) where the gain is completely exempt from tax. The exemption is a lifetime cumulative exemption; therefore, you don’t have to claim the entire amount at once.

The issues we discussed above can be complex. Contact us and your accountant if you have any questions, we can help.

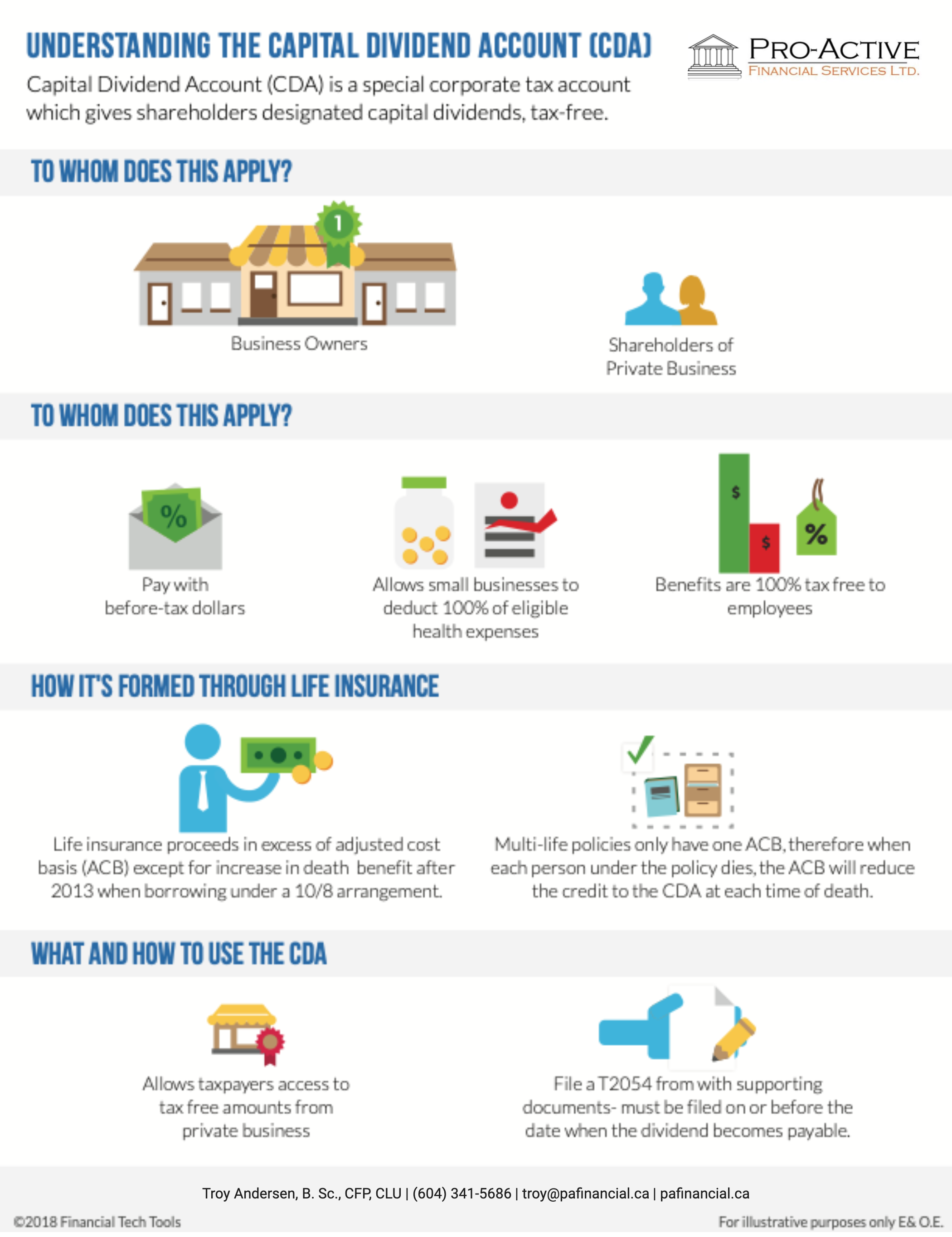

Understanding the Capital Dividend Account

/in blog, Business Owners, corporate, Investment/by Pro Active Financial Services Ltd.

What is the Purpose of the Capital Dividend Account?

Capital Dividend Account (CDA) is a special corporate tax account which gives shareholders designated capital dividends, tax-free. This account is not recorded in the corporation’s taxable accounting entries or financial statements. For this type of account, capital dividend is taken out from paid-in capital and not from retained earnings.

Who benefits from the Capital Dividend Account?

-

Business Owners

-

Shareholders of Private Business

How is the CDA formed through Life Insurance

-

Life insurance proceeds in excess of adjusted cost basis “(ACB)” “except” for increase in death benefit after 2013 when borrowing under a 10/8 arrangement.

-

Multi-life policies only have one ACB, therefore when each person under the policy dies, the ACB will reduce the credit to the CDA at each time of death.

What and how to use the CDA

When capital dividends are paid out to shareholders, these are not taxable. The Capital Dividend Account is part of a tax provision whose goal it is to enable tax-free money received by a company, to then be given to its shareholders, tax free. Therefore, shareholders are not required to pay taxes on these distributions.

The CDA can be complicated, please talk to us to see if this makes sense for your clients.

Accessing Corporate Earnings

/in blog, Business Owners, corporate, life insurance/by Pro Active Financial Services Ltd.

One of the financial planning issues that business owners face is how to access their corporate earnings in a tax efficient way.

There are 5 standard methods:

-

Salary

-

Dividend

-

Shareholder Loans

-

Transfer Personal Assets

-

Income Splitting

There are also unique ways utilizing life insurance and critical illness insurance to access your retained earnings. Please contact us to learn how we can get more money in your pocket than in the government’s.

Succession Planning for Business Owners

/in blog, Business Owners, Estate Planning, Family, life insurance/by Pro Active Financial Services Ltd.

Succession Planning for Business Owners

Business owners deal with a unique set of challenges. One of these challenges includes succession planning. A succession plan is the process of the transfer of ownership, management and interest of a business. When should a business owner have a succession plan? A succession plan is required through the survival, growth and maturity stage of a business. All business owners, partners and shareholders should have a plan in place during these business stages.

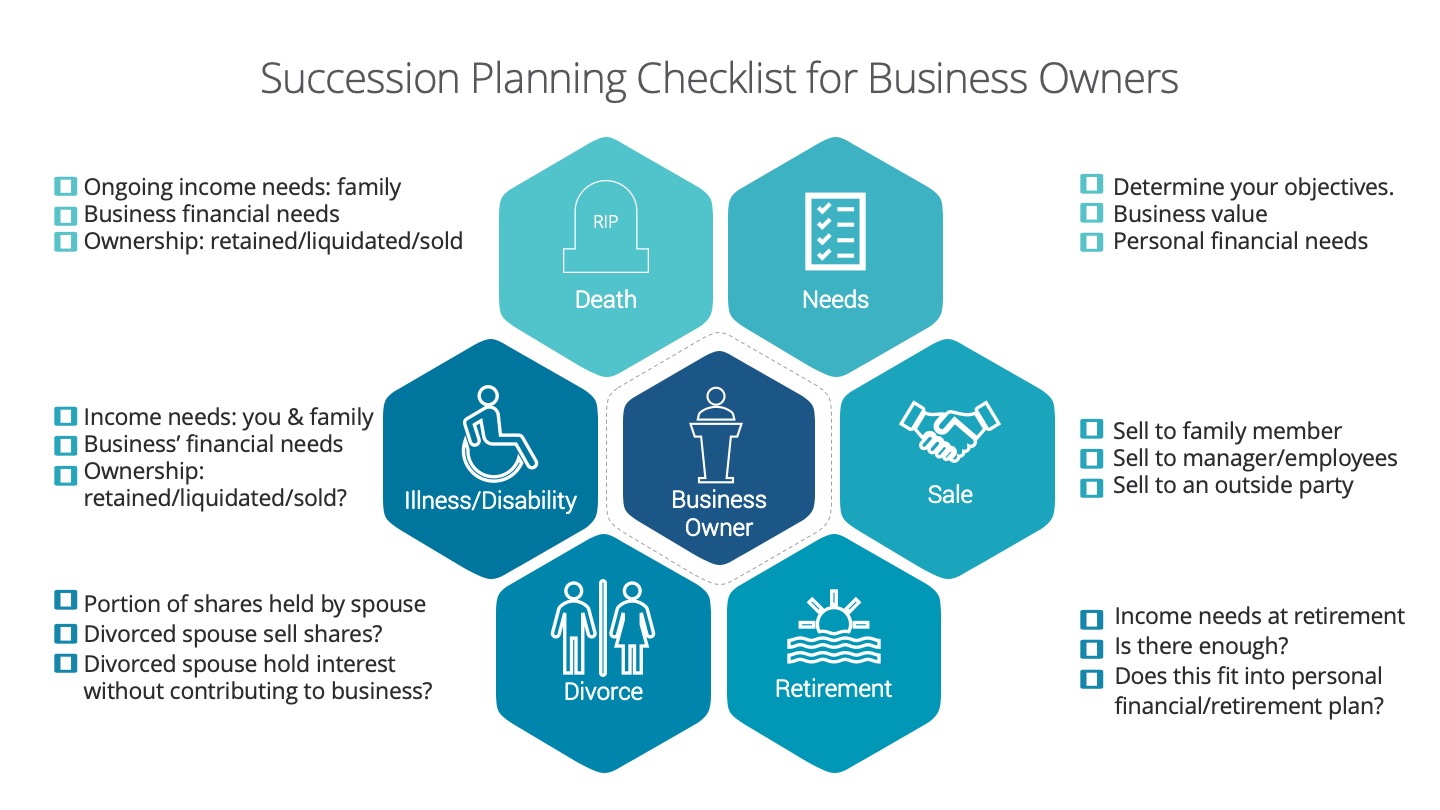

We created this infographic checklist to be used as a guideline highlighting main points to be addressed when starting to succession plan.

Needs:

-

Determine your objectives- what do you want? For you, your family and your business. (Business’ financial needs)

-

What are your shares of the business worth? (Business value)

-

What are your personal financial needs- ongoing income needs, need for capital (ex. pay off debts, capital gains, equitable estate etc.)

There are 2 sets of events that can trigger a succession plan: controllable and uncontrollable.

Controllable events

Sale: Who do you sell the business to?

-

Family member

-

Manager/Employees

-

Outside Party

-

There are advantages and disadvantages for each- it’s important to examine all channels.

Retirement: When do you want to retire?

-

What are the financial and psychological needs of the business owner?

-

Is there enough? Is there a need for capital to provide for retirement income, redeem or freeze shares?

-

Does this fit into personal/retirement plan? Check tax, timing, corporate structures, finances and family dynamics. (if applicable)

Uncontrollable Events

Divorce: A disgruntled spouse can obtain a significant interest in the business.

-

What portion of business shares are held by the spouse?

-

Will the divorced spouse consider selling their shares?

-

What if the divorced spouse continues to hold interest in the business without understanding or contributing to the business?

-

If you have other partners/shareholders- would they consider working with your divorced spouse?

Illness/Disability: If you were disabled or critically ill, would your business survive?

-

Determine your ongoing income needs for you, your spouse and family. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

-

Will the ownership interest be retained, liquidated or sold?

-

How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? Does the business have a savings or insurance program in place to address this?

Death: In the case of your premature death, what would happen to your business?

-

Determine your ongoing income needs for your dependents. Is there enough? If there is a shortfall, is there an insurance or savings program in place to make up for the shortfall amount?

-

Will the ownership interest be retained, liquidated or sold by your estate? Does your will address this? Is your will consistent with your wishes? What about taxes?

-

How will the business be affected? Does the business need capital to continue operating or hire a consultant or executive? Will debts be recalled? How will this affect your employees? Does the business have a savings or insurance program in place to address this?

Execution: It’s good to go through this with but you need to get a succession plan done. Besides having a succession plan, make sure you have an estate plan and buy-sell/shareholders’ agreement.

Because a succession plan is complex, we suggest that a business owner has a professional team to help. The team should include:

-

Financial Planner/Advisor (CFP)

-

Succession Planning Specialist

-

Insurance Specialist

-

Lawyer

-

Accountant/Tax Specialist

-

Chartered Life Underwriter (CLU)

Next steps…

-

Contact us about helping you get your succession planning in order so you can gain peace of mind that your business is taken care of.

Financial Planning for Business Owners

/in blog, Business Owners, corporate/by Pro Active Financial Services Ltd.Financial Planning for business owners is often two-sided: personal financial planning and planning for the business.

Business owners have access to a lot of financial tools that employees don’t have access to; this is a great advantage, however it can be overwhelming too. A financial plan can relieve this.

A financial plan looks at where you are today and where you want to go. It determines your short, medium and long term financial goals and how you can reach them. For you, personally and for your business.

Why do you need a Financial Plan?

-

Worry less about money and gain control.

-

Organize your finances.

-

Prioritize your goals.

-

Focus on the big picture.

-

Save money to reach your goals.

For a business owner, personal and business finances are connected. Therefore both sides should be addressed: Personal and Business.

What does a Financial Plan for a Business include?

There are 2 main sides your business financial plan should address: Growth and Preservation

Growth:

-

Cash Management- Managing Cash & Debt

-

Tax Planning- Finding tax efficiencies

-

Retaining & Attracting Key Talent

Preservation:

-

Investment- either back into the business or outside of the business

-

Insurance Planning/Risk Management

-

Succession/Exit Planning

What does a Personal Financial Plan include?

There are 2 main sides your financial plan should address: Accumulation and Protection

Accumulation:

-

Cash Management – Savings and Debt

-

Tax Planning

-

Investments

Protection:

-

Insurance Planning

-

Health Insurance

-

Estate Planning

What’s the Financial Planning Process?

-

Establish and define the financial planner-client relationship.

-

Gather information about current financial situation and goals including lifestyle goals.

-

Analyze and evaluate current financial status.

-

Develop and present strategies and solutions to achieve goals.

-

Implement recommendations.

-

Monitor and review recommendations. Adjust if necessary.

Next steps…

-

Talk to us about helping you get your finances in order so you can achieve your lifestyle and financial goals.

-

Feel confident in knowing you have a plan to get to your goals.

Investing as a Business Owner

/in blog, Business Owners, corporate, Investment, RRSP, Tax Free Savings Account/by Pro Active Financial Services Ltd.Investing as a Business Owners

Many business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals such as:

-

building and protecting your savings

-

providing for loved ones

-

planning for retirement

Factors to consider when investing as a corporation:

What’s the purpose of the investment? First, think about what you’ll be doing with your savings. This will help dictate what savings vehicle is best suited for your situation. Then consider the following factors:

-

Taxes: As a small business owner, you have access to the small business tax rate which is typically lower than your personal tax rate. (See table below.) Also, as of January 1, 2019, the Federal Budget decreased the small business limit for corporations with a set threshold of income generated from passive investments.

2019 Corporate Income Tax Rates

- Taxes on investment growth: Depending on what you invest in, you will want to review this as different asset types are taxed at different rates.

-

Timing: You can control the timing of the payout which means you could potentially defer paying out the money until you need it and determine if you’d like to pay it out as salary or dividend.

-

Creditor Protection: Sometimes, investments held inside a corporation can be vulnerable to creditors, therefore you may want to consider using a holding company or trust or pay out money to yourself personally. This can be complex and requires professional advice.

-

Capital Gains Exemption: If your investment grows too large, it may endanger your qualification for the lifetime capital gains exemption that ‘s available when shares of a qualified small business corporation are sold or transferred.

For business owners, before investing personally or corporately, it’s certainly worth seeking professional advice to ensure that it suits your individual circumstances.

Contact Us

Troy Andersen

Certified Financial Planner®

President

Tel: 604-341-5686

Email: troy@pafinancial.ca

16741 – 84A Avenue

Surrey, BC

V4N 4W2

Latest News

Personal Life Insurance PlanningJune 2, 2025 - 10:26 pm

Personal Life Insurance PlanningJune 2, 2025 - 10:26 pm 2025 British Columbia Tax RatesMay 1, 2025 - 7:31 pm

2025 British Columbia Tax RatesMay 1, 2025 - 7:31 pm Tax Tips for Filing Your 2024 Income Tax ReturnMarch 31, 2025 - 1:34 pm

Tax Tips for Filing Your 2024 Income Tax ReturnMarch 31, 2025 - 1:34 pm Bank of Canada Announces Interest Rate Cut Amid Economic UncertaintyMarch 12, 2025 - 9:08 pm

Bank of Canada Announces Interest Rate Cut Amid Economic UncertaintyMarch 12, 2025 - 9:08 pm 2025 Canadian Controlled Private Corporation Tax RatesMarch 5, 2025 - 10:44 pm

2025 Canadian Controlled Private Corporation Tax RatesMarch 5, 2025 - 10:44 pm

About

We specialize in providing consulting for Employee benefits including group investment products and Executive benefits and make it understandable for our clients. Service is the cornerstone of our firm. We serve a broad array of clientele; from small businesses to large corporations. As every client is unique we take pride in understanding our clients’ needs and helping them achieve their goals. Being true independent brokers, we only work for our clients and not for any one insurance company. Service matched with solid processes and integrity are the cornerstones of our company. We look forward to working with you now and in the future.

Our Dealer