Understanding the Capital Dividend Account

What is the Purpose of the Capital Dividend Account?

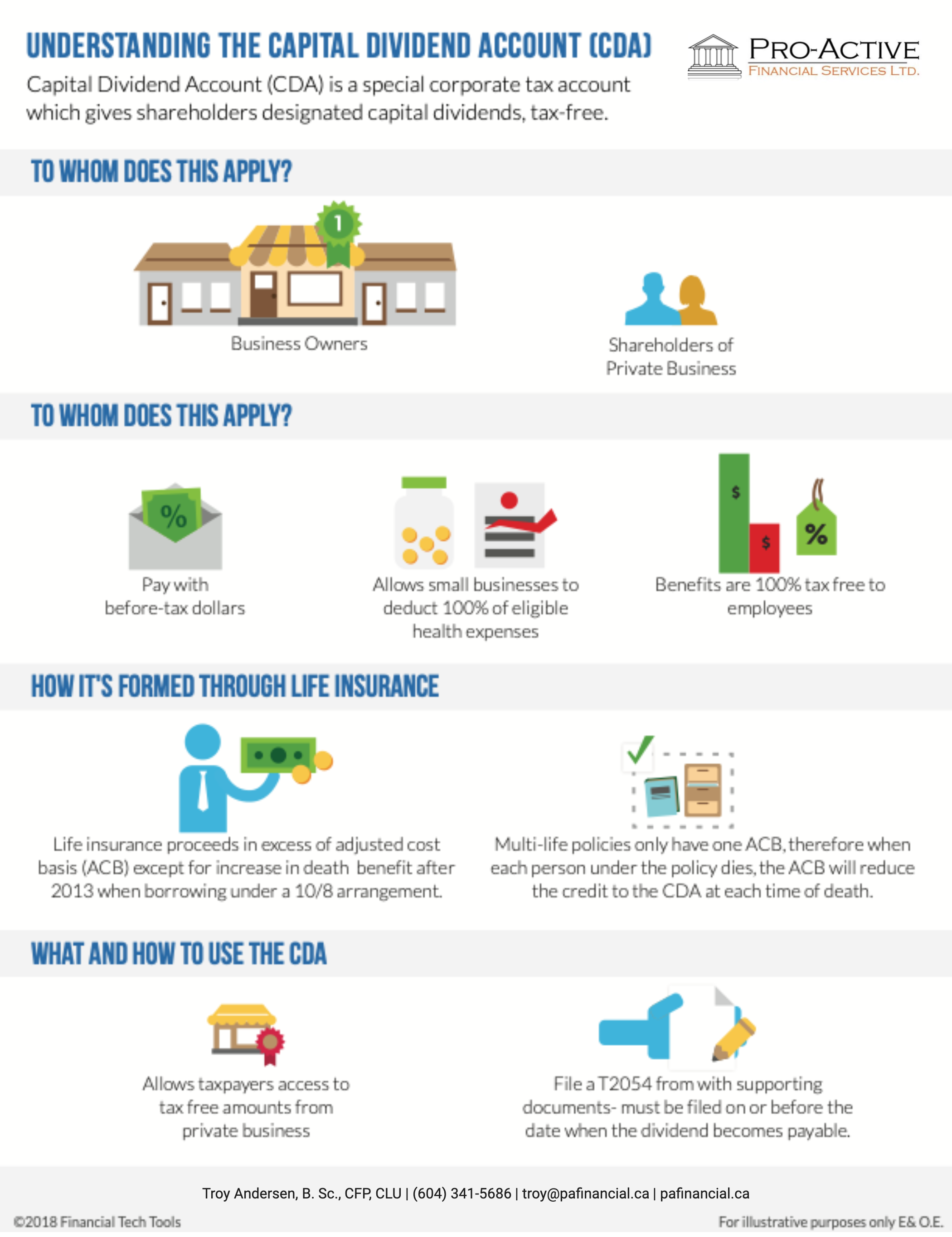

Capital Dividend Account (CDA) is a special corporate tax account which gives shareholders designated capital dividends, tax-free. This account is not recorded in the corporation’s taxable accounting entries or financial statements. For this type of account, capital dividend is taken out from paid-in capital and not from retained earnings.

Who benefits from the Capital Dividend Account?

-

Business Owners

-

Shareholders of Private Business

How is the CDA formed through Life Insurance

-

Life insurance proceeds in excess of adjusted cost basis “(ACB)” “except” for increase in death benefit after 2013 when borrowing under a 10/8 arrangement.

-

Multi-life policies only have one ACB, therefore when each person under the policy dies, the ACB will reduce the credit to the CDA at each time of death.

What and how to use the CDA

When capital dividends are paid out to shareholders, these are not taxable. The Capital Dividend Account is part of a tax provision whose goal it is to enable tax-free money received by a company, to then be given to its shareholders, tax free. Therefore, shareholders are not required to pay taxes on these distributions.

The CDA can be complicated, please talk to us to see if this makes sense for your clients.