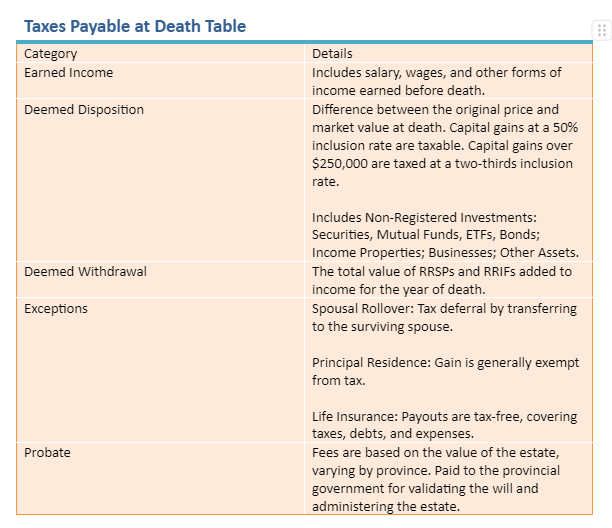

Understanding Taxes Payable at Death in Canada

A common belief among Canadians is that they will be taxed on money they inherit. However, Canada does not impose an inheritance tax. Instead, after someone passes away, their final tax return must be filed, covering the income they earned up to the date of death. Any taxes owed are paid from the estate’s assets before the remaining funds are distributed to the beneficiaries.

While there isn’t an inheritance tax in Canada, other costs are associated with settling an estate. It’s important to understand these costs and how the process works.

Is There an Estate Tax in Canada?

Canada doesn’t have a traditional estate tax, but there are taxes and fees that apply after death. The Canada Revenue Agency (CRA) ensures that taxes are paid on any income earned up to the date of death. If there is a tax balance owing, the executor of the estate must file a final tax return and settle any outstanding taxes.

Earned Income

When you pass away, any earned income up to the date of death is included in your final tax return. This includes salary, wages, and other forms of income earned before death.

Deemed Disposition

Deemed disposition occurs when all your assets are treated as if they were sold at their current market value upon death. This means the difference between the original purchase price and the market value at the time of death is considered a capital gain.

Capital Gains:

If your assets have increased in value, the difference (capital gain) is taxable. Effective June 25, 2024, 50% of this gain is included in your income unless the total gain exceeds $250,000, in which case any amount above the first $250,000 the inclusion rate increases to two thirds.

What Property Does Deemed Disposition Apply To:

-

Non-Registered Investments: Securities, Mutual Funds, ETFs, Bonds

-

Income Properties

-

Businesses

-

Other Assets

Deemed Withdrawal

Deemed withdrawal applies to registered accounts such as RRSPs and RRIFs. The total value of these accounts is added to your income for the year of death, potentially leading to a significant tax liability.

Example: Earned Income, Deemed Disposition, and Deemed Withdrawal (Effective June 25, 2024)

Let’s consider an example to illustrate how earned income, deemed disposition, and deemed withdrawal work together, including how much of the estate is kept after taxes and how much is paid in taxes:

Scenario:

-

John earned $60,000 in salary up to the date of his death.

-

He owns an income property, stock portfolio and an RRSP.

-

Income Property: Purchased for $200,000, now worth $500,000.

-

Stock Portfolio: Purchased for $50,000, now worth $100,000.

-

RRSP: Total value of $150,000.

Earned Income:

-

John’s earned income of $60,000 is included in his final tax return.

Deemed Disposition:

1. Income Property:

-

Original Purchase Price: $200,000, Market Value at Death: $500,000

-

Capital Gain: $500,000 – $200,000 = $300,000

-

First $250,000 taxed at 50%: $125,000

-

Remaining $50,000 taxed at two-thirds: $33,333

-

Total Taxable Gain: $125,000 + $33,333 = $158,333

2. Stock Portfolio:

-

Original Purchase Price: $50,000, Market Value at Death: $100,000

-

Capital Gain: $100,000 – $50,000 = $50,000

-

Taxable Portion: 2/3 of $50,000 = $33,333 (Net capital gains exceed $250,000)

Deemed Withdrawal:

-

RRSP Value: $150,000

-

Added to Income: $150,000

Total Taxable Income Calculation:

-

Earned Income: $60,000

-

Taxable Gain from Income Property: $158,333

-

Taxable Gain from Stocks: $33,333

-

RRSP Added to Income: $150,000

-

Total Taxable Income: $60,000 + $158,333 + $33,333 + $150,000 = $401,666

Tax Liability:

-

Assuming John’s tax rate is 30%, his tax liability would be:

-

Total Tax Owed: 30% of $401,666 = $120,500

Estate’s Remaining Value:

-

John’s estate would need to pay $120,500 in taxes, which is 16.06% of the total estate value.

-

If the total value of the assets is $750,000 (including the stock portfolio, income property, and RRSP), the remaining value after taxes would be:

-

Remaining Estate Value: $750,000 – $120,500 = $629,500, which represents 83.93% of the estate.

So, after paying $120,500 in taxes, John’s estate would keep $629,500 to be distributed to the beneficiaries.

Strategies to Address Estate Taxes

To manage the tax burden on your estate, several strategies can be considered:

-

Spousal Rollovers: Deferring taxes on RRSPs, RRIFs, and other assets by transferring them to your spouse can delay the tax liability until those assets are withdrawn or disposed of.

-

Gifting Assets: Spreading out the gifting of assets over several years can reduce the overall taxable income in the year of death.

-

Use of Life Insurance: Life insurance can provide funds to cover taxes, ensuring that your estate remains intact for your beneficiaries.

-

Planning with a Will: Creating a detailed will that considers tax implications can help in minimizing the taxes payable and ensure your wishes are followed.

-

Consider Trusts: Setting up trusts can be a way to manage and protect your assets, potentially reducing tax burdens.

Implementing these strategies effectively requires careful planning and consideration of your unique circumstances. Professional guidance can help tailor these strategies to your needs.

Understanding these rules helps in planning your estate effectively. For more personalized advice, feel free to contact us.